Hello Friends

Good Morning, good afternoon and good evening

I hope all of you had a great weekend, I hope you enjoyed the French Open, as the Women’s number one left early and Novak survives a scare to remain in the tournament and I hope everybody is getting ready for the European Cup this weekend.

But back to the financial markets

On the menu today is the commodity Oil.

It seems that oil has taken another hit as price dropped for the 5th day in a row. Reports have it that the decline in economic growth in both the US and China have contributed to the lowest prices seen in months.

As last week’s US unemployment rose and payrolls increase less than forecasted along with China’s weak non manufacturing purchasing managers index the futures for oil dropped as much as 8.4%

Bloomberg Stats:

“Oil for July delivery fell as much as $1.91 to $81.32 a barrel in electronic trading on the New York Mercantile Exchange and was at $81.51 at 9:47 a.m. in London. Prices slid 3.8 percent on June 1, capping the biggest weekly drop since Sept. 23. Oil is 17 percent lower this year.”

But like always with all bad news comes opportunity

So let’s see what opportunities Oil could present to us

Oil:

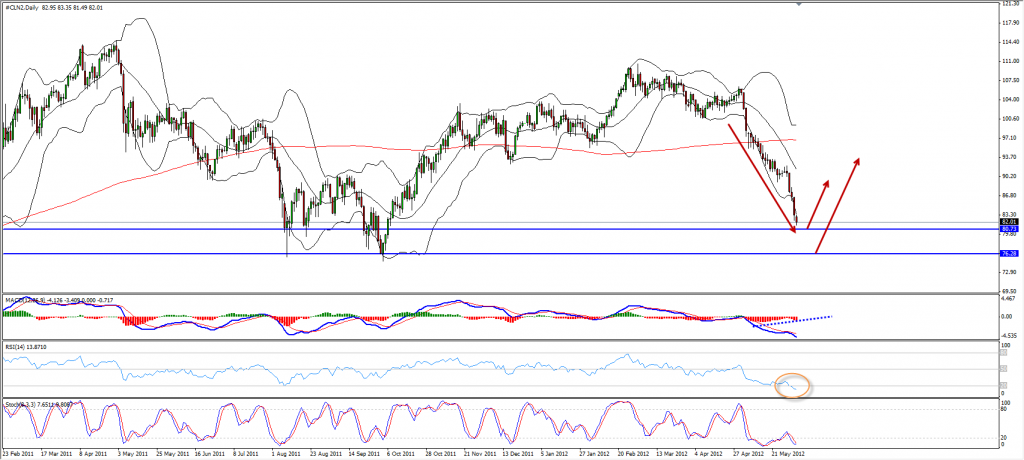

Has had a crash of more than 2000 points, RSI is very extreme. It is now more than 20 candles down and the weekly chart has created for us a Bollinger Band duplication. We have support around 80.73 and another just below around 76.28. They are far apart which makes this trade very risky this trade should only be considered if you have an account of at least 5k and you use negative leverage.

That’s all for now

Until next time

Vladimir