The S&P 500 rose after notching its first weekly decline since mid-March. Most of the main 11 industry groups gained, with energy and financial shares jumping the most. Small-cap stocks in the Russell 2000 rallied four times as much as the broader market. The U.S. 10-year Treasury yield climbed for the second straight session, hovering hear its 50-day moving average. The dollar erased a loss. Copper, seen as a barometer of growth, surged to the highest in a decade.

Investors this week will focus on corporate earnings and U.S. economic data even as the Fed primes them to expect no change to policy at their two-day meeting ending Wednesday. While emerging economies from India to Brazil are grappling with a Covid-19 surge or renewed curbs, the developed world is on a firmer recovery path with a faster pace of vaccination.

“The Fed is going to likely reiterate their patient stance here,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management. “I’m anticipating that they acknowledge the recent strength we’ve seen in economic data but they will continue to highlight we are a ways away from achieving their goal of full employment. I think they’ll continue to assure markets that Fed policy is going to remain firmly dovish for some time.”

Data Thursday may show U.S. gross domestic product increased at a 6.9% annualized pace from January through March after a more moderate 4.3% rate in the previous quarter. Other reports this week may show a pickup in consumer confidence and robust personal spending. Recent indicators cemented economic optimism, with durable-goods orders rebounding in March and output at manufacturers and service providers reaching a record high in April.

A slew of earnings from megacaps including Tesla Inc., Facebook Inc. and Apple Inc. will also be parsed this week as investors look for clues on how companies are faring in the recovery.

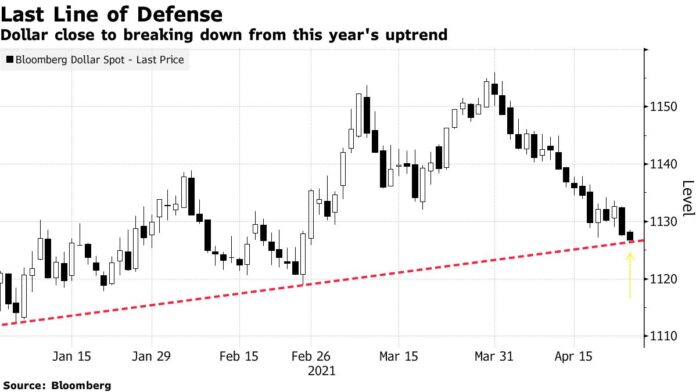

European stocks advanced Monday, as gains for banks and travel companies offset losses for food companies and utilities. The dollar was little changed after initially falling to a two-month low. It was still on course for the biggest monthly drop this year.

Oil retreated amid concern demand from India may fall after the nation reported a million new coronavirus cases in three days.

Here are some key events to watch this week:

- Bloomberg Live hosts the Bloomberg Green Summit Monday through April 27

- Bank of Japan rate decision and Governor Haruhiko Kuroda briefing Tuesday

- Fed Chair Jerome Powell holds a press conference Wednesday following the FOMC meeting

- Joe Biden makes his first address as president to a joint session of Congress Wednesday

- U.S. GDP is forecast to show robust 6% growth in the first quarter, bolstered by government stimulus Thursday

These are some of the main moves in markets:

Stocks

- The S&P 500 rose 0.2% as of 9:58 a.m. New York time

- The Dow Jones Industrial Average rose 0.2%

- The Russell 2000 Index rose 0.8%

- The MSCI Emerging Markets Index rose 0.5%

- The Stoxx Europe 600 rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3% to $1.2065

- The British pound was little changed at $1.3886

- The Japanese yen fell 0.1% to 108.02 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.56%

- Germany’s 10-year yield was little changed at -0.26%

- Britain’s 10-year yield was little changed at 0.75%

Commodities

- West Texas Intermediate crude fell 1.4% to $61 a barrel

- Gold futures were little changed