Hi Traders! USDCHF forecast follow up and update is here. On February 17th I shared this “Technical Analysis – USDCHF Forecast” post in my blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

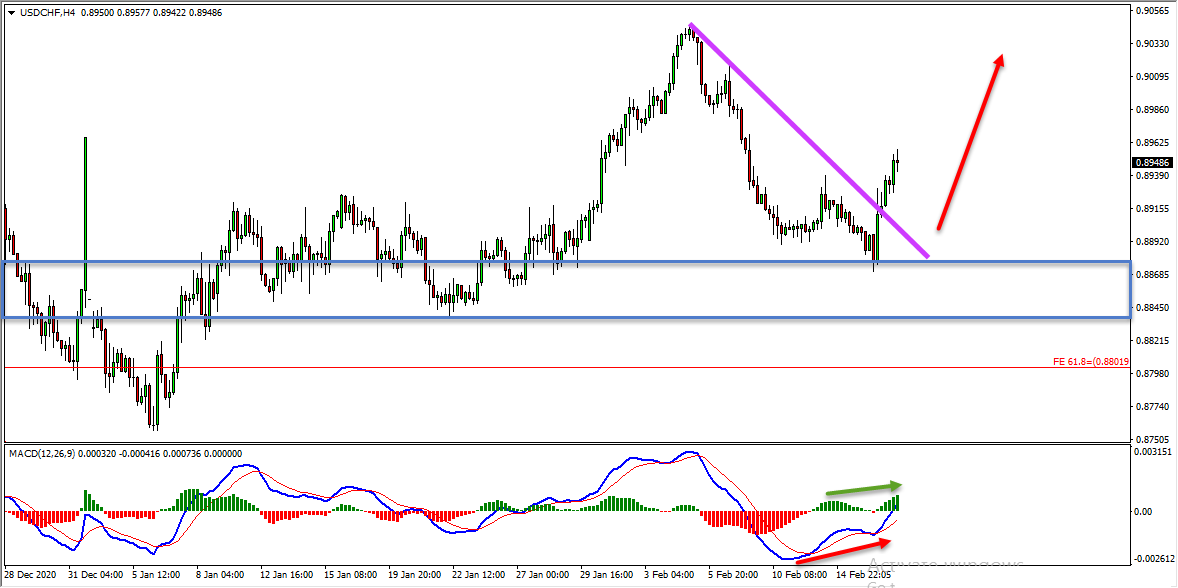

On the H4 chart, the price has created a bullish divergence between the first low that has formed at 0.88897 and the second low that has formed at 0.88706 based on the MACD indicator. Then the price moved higher and broke above the high at 0.89391 creating higher highs, thus forming a classical setup of bullish divergence followed by bullish convergence. Hence as per the book scenario, after a bullish convergence, we may look for corrections to happen and then further continuation to the upside. Also, the price which is moving higher has broken above the most recent downtrend line which we may consider as another evidence of bullish pressure. So everything looks good here for the bulls and until the strong support zone shown in the screenshot below (marked in blue) holds my view remains bullish here.

USDCHF H4(4 Hours) Chart Current Scenario

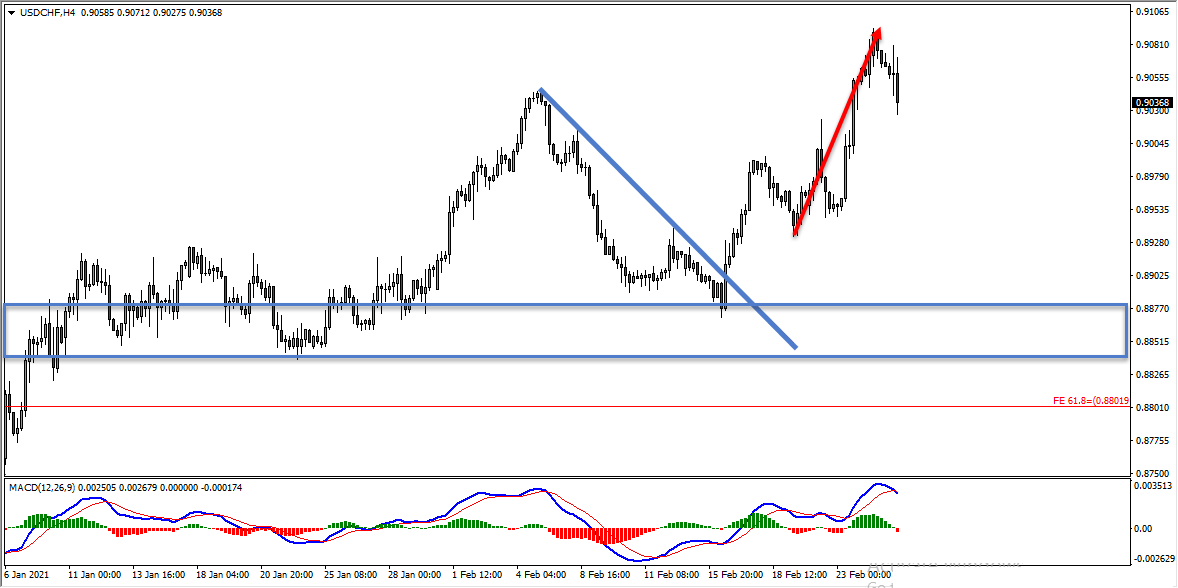

Based on the above-mentioned analysis my view was bullish here and I was expecting the price to move higher further. On the H4 chart after the bullish convergence and the breakout of the most recent downtrend line, we had a small pullback and then the price moved higher further as I expected it to, delivering 160+ pips move so far.

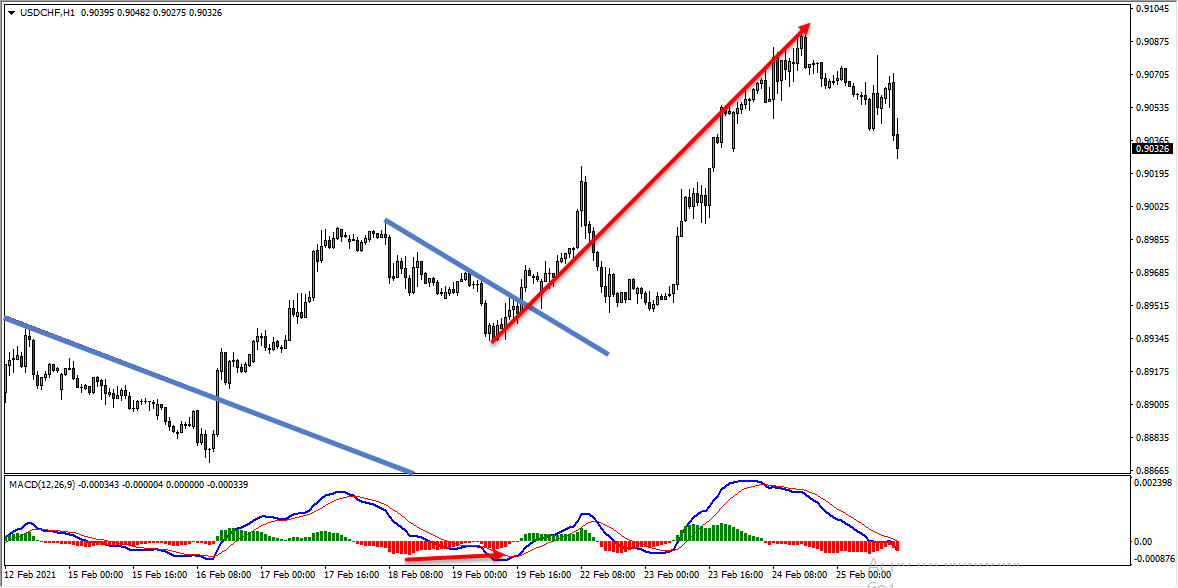

On the H1 chart, the market provided us with various facts supporting the bullish view. The pullback which happened after the bullish convergence and the most recent downtrend line breakout on the H4 chart happened in the form of a double wave down on the H1 chart. In addition to this, the price has also created a bullish divergence that had formed between the first low that has formed at 0.89567, and the second low that has formed at 0.89334 based on the MACD indicator. Then the price moved higher and broke above the most recent downtrend line, we may consider these as facts provided by the market supporting the bullish view. Also, there were no signs opposing this bullish view and then the price moved higher further, providing an amazing move to the upside.

(Note: You can learn about a Killer Forex Strategy “Double Trend Line Principle” here)