Hi Traders! Today I am sharing with you the AUDCAD technical analysis and short term forecast post. The way I would like to analyze the chart for setups is based on multi-timeframe confirmations because in my POV if we get more evidences on different timeframes for the same direction then it makes the setup much more reliable. We do our analysis on the MetaTrader4 platform (MT4), some very interesting, useful tips and hacks about the MT4 platform could be found here. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club Spoiler alert – free memberships are available! Now, let’s start our analysis from the highest timeframe which will be the daily chart here.

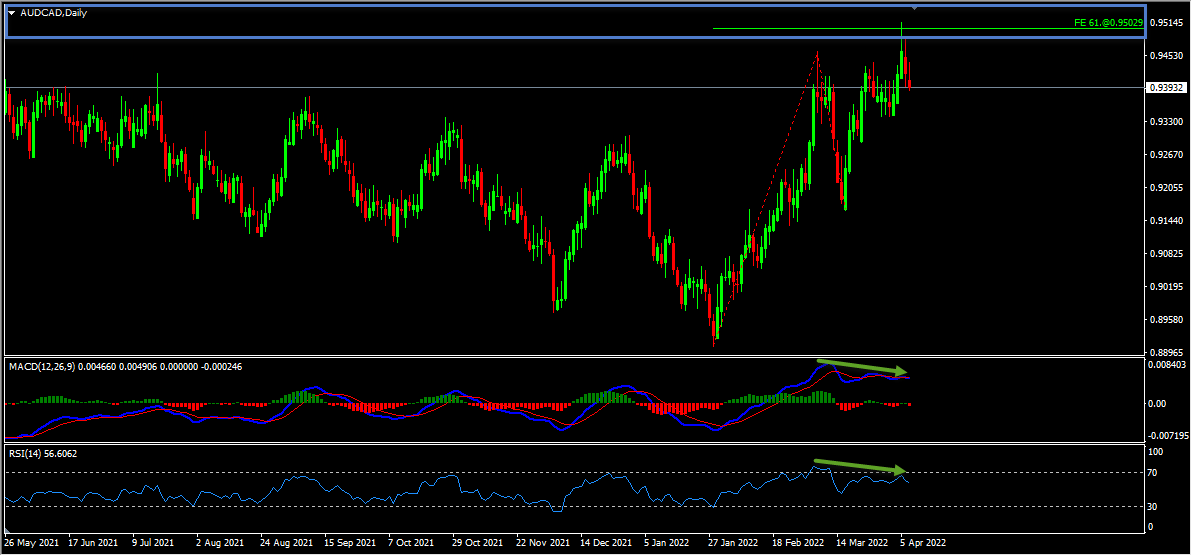

AUDCAD D1(Daily) Chart Analysis – Key Resistance Zone, Bearish Divergence

On the daily chart, the price which was moving higher reached a key resistance zone formed by the 61.8%(0.95000)Fibonacci expansion level of the first wave. The price respected this key resistance zone and is currently bouncing lower from this zone. In addition to this, we had a bearish divergence that has formed between the first high that has formed at 0.94616 and the second high that has formed at 0.95153 based on the MACD indicator which we may consider as evidence of bearish pressure. In addition to this, we have this bearish divergence on the RSI indicator as well which we may consider as yet another evidence of bearish pressure. So everything looks good here for the bears and until the key resistance zone holds my short term view remains bearish here.

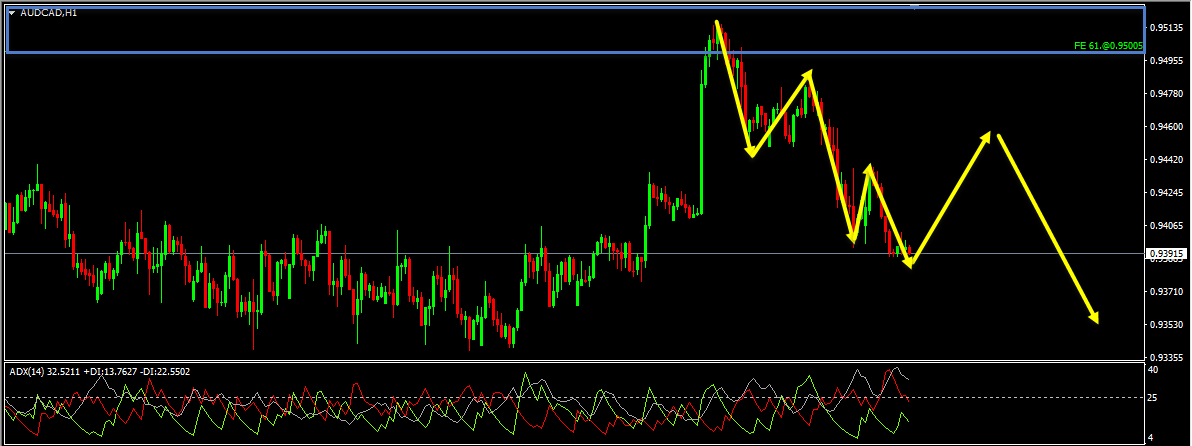

AUDCAD H1(1 Hour) Chart Analysis – Bearish Trend Pattern, ADX Indicator

On the H1 chart, we could see that the price which was moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Also, the ADX indicator gave a bearish signal here at the cross of -DI (red line) versus +DI (green line) and the main signal line (silver line) reads value over 25 which we may consider as yet another evidence of bearish pressure. Until this key resistance zone (marked in blue) shown in the image below holds my short term view remains bearish here and I expect the price to continue lower further after pullbacks.

Technical Analysis & Forecast Summary

AUDCAD D1(Daily) Chart Analysis

- Key Resistance Zone, Bearish Divergence

AUDCAD H1(1 Hour) Chart Analysis

- Bearish Trend Pattern, ADX Indicator

Trading Tips

It is always recommended to look for confirmations before you jump into any trade. If you are not sure about how to trade this short term sell setup then you can use any setup and strategy that you have in your arsenal to look for bearish moves and join this sell trade.

Also, don’t forget to protect your sell trade using a stop loss and make sure to set a target and keep a proper risk/reward ratio.

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

Not sure how to enter a trade? Spot reversals (bounces)? Not sure how to spot breakouts?

I invite you to

And improve your trading with us.

Also, you can get one of our strategies free of charge. You will find all the details here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Traders Academy Club Team