AvaTrade, originally pioneered as AvaFX, is an award-winning FX and CFD broker that was founded in 2006. Regulated by multiple financial authorities, AvaTrade’s platform provides a broad number of trading features, free educational resources, and competitive industry spreads. Minimum deposits start as low as $100 while AvaTrade supports 5 trading platforms that are designed to support an investor of any caliber.

According to the mission statement, AvaTrade was founded with the primary mission to empower people to trade with confidence. Supporting over 125 instruments such as forex, cryptocurrencies, stocks, commodities, and indices while segregating cliental funds for increased security, AvaTrade provides quite the list of advantages that should be considered with thought by prospective day traders.

The platform supports over 20 languages and is regulated in Europe, Australia, Japan, South Africa, and the British Virgin Islands. For over 11 years traders have relied upon AvaTrade to support their online trading journey and we predict that for the next 11 years these truths will remain whole.

To learn more regarding this forex and CFD provider we invite you to read our comprehensive AvaTrade review.

AvaTrade Pros & Cons

Cons

- Limited 21 Day Demo Account

- No real-time news feed or research capability

Pros

- Innovative social trading

- Expansive educational hub (free)

- Multilingual platform with multiple regulations

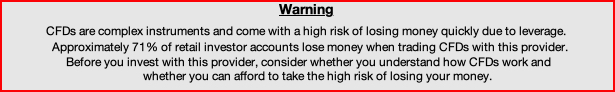

Trading Fees

Compared to industry competitors, AvaTrade is more affordable and reflects low-to-competitive fees. While AvaTrade reflects a transparent fee structure, the brokerage doesn’t go out of the way to educate prospective investors regarding their trading and non-trading fees.

While trading brokerage tends to reflect varying fees ideal to their business model, AvaTrades non-trading fees are in line with similar forex and CFD brokers.

AvaTrade’s Fee Oversight

S&P 500 CFD – The average spread cost is 0.5, fees are incorporated into the spread.

Europe 50 CFD – Average spread cost is 1 pip, fees incorporated into the spread.

EUR/USD – The average spread cost if 0.9 pips, fees are included in the spread.

3 Consecutive Month Inactivity Fee (Quarterly) – $50.00.

12 Consecutive Month Inactivity Fee (1 Year) – $100.00.

Deposit Fees? – No.

Withdrawal Fees? – No.

Account Opening [+ Types]

The account creation process with AvaTrade is entirely virtual and is accompanied by a Free 21-Day Demo Account. Approval of deposits vary depending upon funding method but typically traders can begin trading within a few minutes to 10 business day.

Minimum Deposit (credit/debit): $100.00

Minimum Deposit (wire): $500.00

Maximum Deposit: $20,000.00

Supporting Payment Methods: Visa, MasterCard, Skrill, Neteller & E-Wallet

E-payments such as funding through Skrill, WebMoney, and Neteller can be credited as soon as the next day although withdrawals can take up to 10 business days to be received.

What kind of account types are available at AvaTrade?

- Standard Trading Account – For Individuals

- Corporate Trading Account – For Legal Entities

- Islamic Trading Account – Swap-Free account

Swap-free means that owners of Islamic Trading Accounts are not charged for swaps.

You should also be made aware that if you are a seasoned trader, you can request for AvaTrade to open a Professional Trading Account, although your portfolio must reflect a value of no less than €500,000.

So you are more familiar with the features and functionality of AvaTrade, we suggest that traders create a demo account before to funding their trading account.

Deposit & Withdrawal

Withdrawals through AvaTrade are free and do not possess hidden fees.

Additionally, there are no deposit fees while withdrawals are estimated to take between 1 to 3 business days to reach you.

Supported base currencies include USD, AUD, CHF, EUR, and GBP.

AUD currency is solely available for citizens of Australia while GBP is supported for clients who reside within the United Kingdom.

** Pro Tip: Make sure whichever currency you choose to have your account set up for that you stick with that currency, otherwise you may be charged a currency conversion fee. A couple of examples include Revolut or Transferwise, both of which support a multitude of currencies with free to low international banking transfer fees. According to members, registration with either entity takes no more than a handful of minutes to complete. **

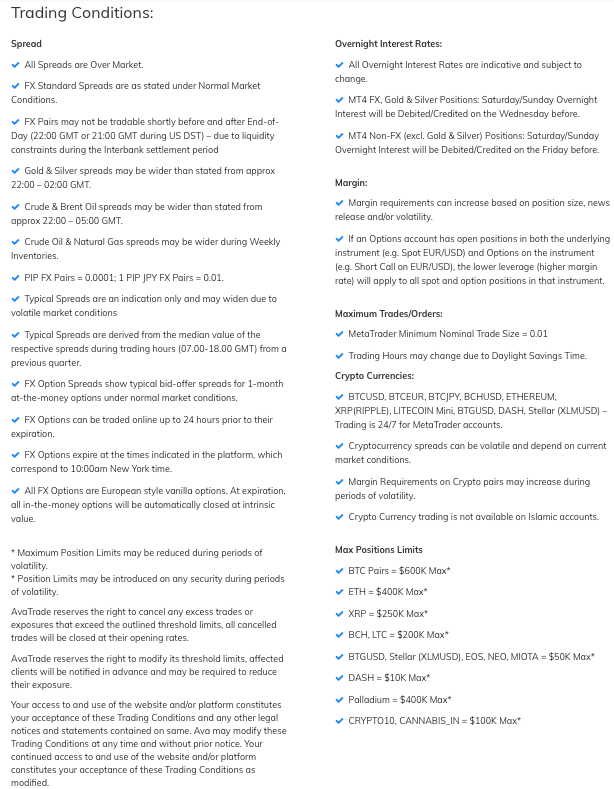

Regulations

Available in 6 jurisdictions, AvaTrade is regulated by the following regulatory bodies:

- AVA Trade EU – Central Bank of Ireland (No. C533877)

- AVA Trade LTD – B.V.I. Financial Services Commission

- Ava Capital Markets Australia Pty Ltd – ASIC (No. 406684)

- Ava Trade Japan K.K. – FSA (No. 1662) and the FFAJ (No. 1574)

- Ava Capital Markets Pty – South African Financial Services Board (FSP No. 45984)

- Ava Trade Middle East LTD – Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) (No. 190018)

Headquartered out of Ireland, AvaTrade operates multiple subsidiaries as you can see.

Depending upon where you reside will dictate which subsidiary serves you.

Why is this important?

This is considered important because depending upon where you reside and which subsidiary is serving you will decide how regulators differ from one another along with how much of your invested funds are safe, therefore make sure you do educate yourself beforehand and don’t deposit more than what is protected.

The legal entity, AVA Trade EU LTD, is the only AvaTrade entity currently offering client fund protection (up to €20,000) although given that the client’s funds are segregated and AvaTrade reflects more regulators than most online brokerages you are in good hands.

Trading Features & Products

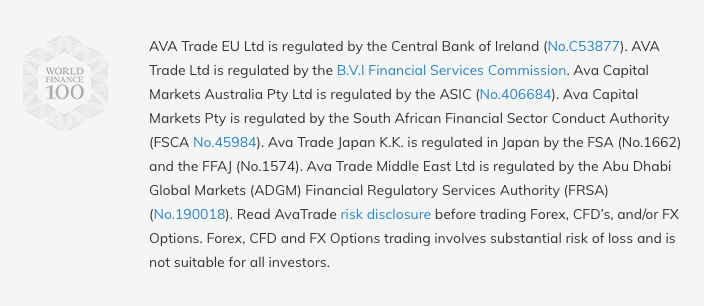

Trading Platform

Since last year, AvaTrade has significantly stepped up their game in regards to supported trading platforms, live trading features, and their free trading resources.

Not long ago the only supported platform available through AvaTrade was MetaTrader4 (MT4).

Since then, however, AvaTrade has gone on to implement 4 additional trading platforms such as MetaTrader5 (MT5), AvaOptions, AvaTradeGO, and Automated Trading (Auto-chartist).

While AvaTrade’s platform is more geared towards mobile traders, traditional desktop traders tend to gravitate towards more long-standing trading platforms such as the widely used MetaTrader4 platform.

Transparent order confirmations along with flexible customization to charting solutions are two strong advantages of AvaTrade’s platform although if we are being honest the platform would benefit from additional price alert settings along with a more crisp design.

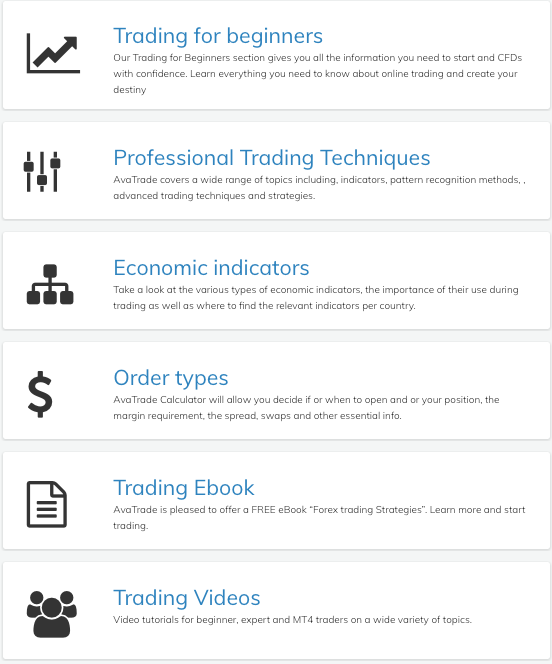

Broad Trading Education

When compared to competing forex brokers, AvaTrade offers a much more condensed and comprehensive educational hub for novice to intermediate level traders.

What’s nice about the educational department of AvaTrade would be that there is an entire section dedicated to Trading for Beginners while day traders also can learn about the following:

- Order Types

- Economic Indicators

- Pattern Recognition Models

- Advanced Trading Techniques

- Forex and CFD Trading Strategies

There is a section for seasoned traders while we found the fundamentals covered throughout the Trading for Beginners a good crash course in the fundamentals you should educate yourself before investing live.

Additionally, there are trading e-books and video tutorials that are handy if you are more of a watch-and-learn type of learner.

Customer Service

Unlike some investment brokers where you’d have better luck getting answers from a rock, AvaTrade provides a relatively decent customer support team while providing relevant answers to inquiries.

Additionally, AvaTrade has does quite an effective job of expanding their FAQ to cover the vast majority of questions that tend to come up amongst traders who are looking to learn more regarding their platform.

You may also use a search feature to navigate through the site’s articles and FAQ to find your answer more quickly.

Bottom Line

AvaTrade is an industry-leading foreign exchange and globally operated CFD broker that was founded in 2006.

Regulated by 7 financial authorities, including the Bank of Ireland and the Australian Securities and Investments Commission (ASIC), AvaTrade provides a safe trading platform for traders residing within Europe, Australia, Japan, South Africa, and more other countries.

We enjoyed the user-friendly account opening process while we found their trading fees to be slightly below industry average to competitively priced.

More importantly, we thought that AvaTrade did an excellent job constructing a thorough educational learning hub while being conscientious regarding their in-depth FAQ Guide and helpful customer support was top-notch.

Despite the draws of the platform, such as limited financial instruments and lack of customizable trading tools, we found AvaTrade to be a rather complete broker while their minimum deposit is among one of the lowest in the trading industry.

Make sure to stay active with AvaTrade otherwise you may be subject to inactivity fees and don’t forget to try out their demo trading platform before investing live.

Very helpful. Thank you team