Cryptocurrency Year-To-Date Drop Surpasses NASDAQ’s Dot-Com Drop. In what may be one of the most significant concerns to people in the cryptocurrency field, the year-to-date drop of the value of the cryptocurrency field has surpassed that of what the NASDAQ had in 2000 following the dot-com burst that wiped out much of the field.

In 2000, the NASDAQ Composite Index lost about 78 percent of its value. This was the peak-to-trough drop in the index for the year. Much of the drop was due to many dot-com stocks falling as that market bubble burst.

Meanwhile, the MVIS CryptoCompare Digital Assets 10 Index has experienced a drop that is slightly greater than that of what was experienced by the NASDAQ exchange. The drop from the market’s peak in January has totaled about 80 percent. The rate of decline is also consistent with what had been experienced by NASDAQ during that same time period.

Much of this has come from how the people who invested in the crypto field were convinced that the industry would grow to where the industry would revolutionize how people use money and interact with each other. The industry continues to grow and thrive with many currencies popping up, but there are concerns at this point about how the market is struggling to move forward.

Concerns and Cause of Optimism

The main concern in this situation comes from security-related issues, market changes and manipulation, and added regulations on the industry. But even with these concerns, people who support the crypto field are still bullish on the currency field.

Even with these changes, there are arguments that this will be a small lull in the field. In a report posted by Fortune, people who are bullish on the field argue that the NASDAQ has more than recovered from 2000 and that the internet has proven to be more valuable now than what people thought it would have been back then.

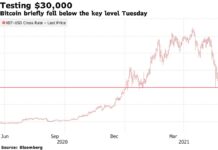

The general changes in the industry are still significant when all is considered. Bitcoin values have particularly fallen. In January, the currency was listed at $17,000 per token with a market cap of nearly $290 billion. Today that total has fallen to below $6,500 with a market cap less than $110 billion.

Additional Fears

There are worries in the field that the values of cryptocurrencies could continue to decline after a while. A report from Seeking Alpha writer Geoffrey Caveney states that there are legitimate concerns that the bitcoin could fall below $1,000 in value before the end of the year. He argues that investors are too confident in the market and are not aware of some of the risks that might be coming along within the field. Her also argues that the field is far too similar to that of what the market has been working with.

The main concern about the market, according to Caveney, is that the field is too volatile and that people are not fully aware of what could happen in the market. This has created significant concerns over what might happen with the currency field in the future.