Hi Traders! EURGBP short term forecast update and follow up is here. On March 1st, 2023 I shared this “EURGBP Technical Analysis And Short Term Forecast” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Home Trader Club. Spoiler alert – free memberships are available!

My Idea

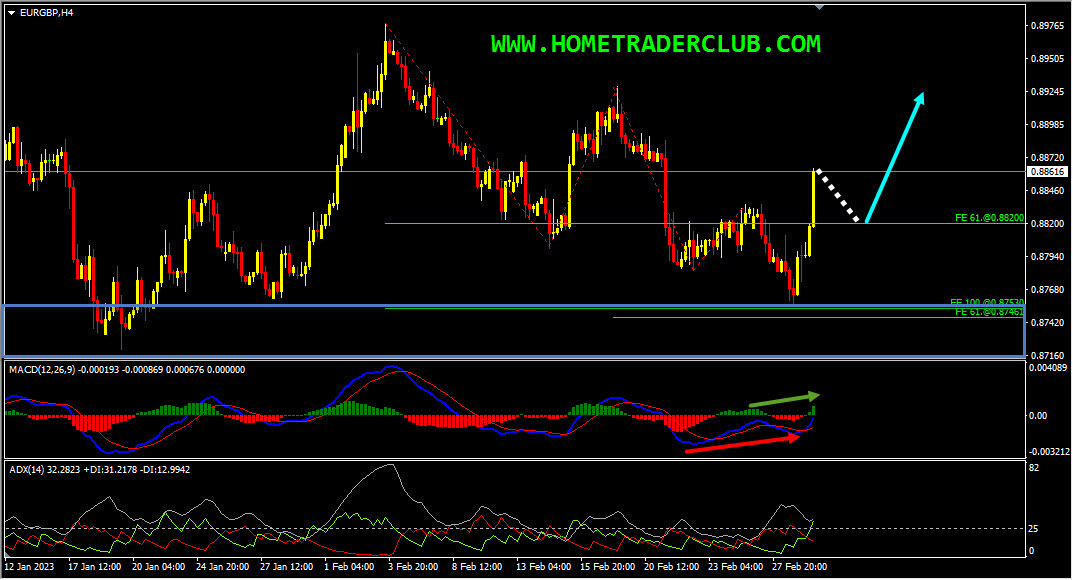

On the H4 chart, the price which was moving lower reached a key support zone. This key support zone is formed by the 100%(0.87530) Fibonacci expansion level of the big wave, the 61.8%(0.87461) Fibonacci expansion level of the small wave. The price respected this zone and bounced higher from this zone. Also, we could see that the price which was moving lower created a bullish divergence that has formed between the first low that has formed at 0.87832 and the second low that has formed at 0.87546 based on the MACD indicator. The price then moved higher and broke above the last high at 0.88352 creating higher highs, thus forming a classical setup of bullish divergence followed by bullish convergence. Hence as per the book scenario, after a bullish convergence, we may look for corrections to happen and then further continuation to the upside. Currently, it looks like a correction is happening. In addition to this, the ADX indicator gave a bullish signal here at the cross of +DI (green line) versus -DI (red line) and the main signal line (silver line) reads value over 25, we may consider this as yet another evidence of bullish pressure. Also, currently, there are no signs opposing this bullish view. So based on all this, until the key support zone holds my short-term view remains bullish here and I expect the price to move higher further.

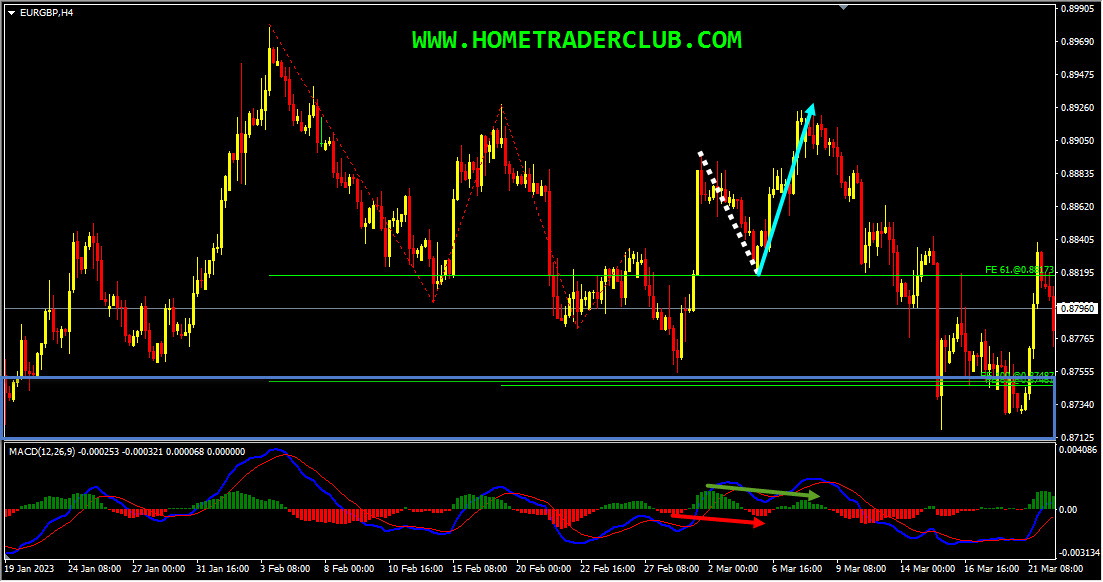

EURGBP H4(4 Hours) Chart Current Scenario

Based on the above-mentioned analysis my short-term view was bullish here and I was expecting the price to move higher further until the key support zone holds. The price action followed my analysis here exactly as I expected it to. After the bullish convergence, the pullback that I was looking for happened with the price creating a bullish hidden divergence between the first low formed at 0.87546 and the second low formed at 0.88198 based on the MACD indicator, which we may consider as a fact provided by the market supporting the bullish view. Also, there were no signs opposing this short-term bullish view. The price then moved higher further and delivered a nice move to the upside, until it was blocked by a bearish divergence.

So, traders, this is why I wanted to show this example to help you understand how important it is to follow the facts. The facts were supporting the bullish view here and there were no signs against it. When the facts do happen as we expected you can see how the price perfectly moved as per the plan. Because these are the kind of hints the market provides us with the majority of the time and it’s our obligation as traders to be able to listen to these things that the market tells us and we should try to make the right actions accordingly.

For similar trade ideas and much more I invite you to

Also, you can get one of our strategies free of charge. You will find all the details here

Download our best forex indicators here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Home Trader Club Team.