Hi Traders! Gold forecast update and follow up is here. On August 19th I shared this “Gold Forecast And Technical Analysis” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

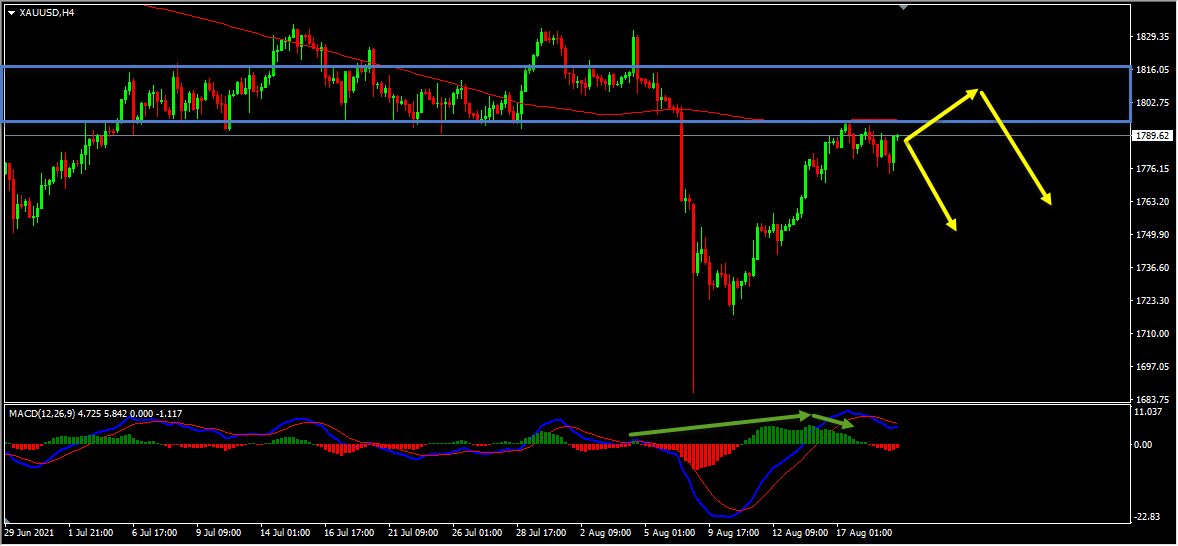

On the H4 chart, we have a strong resistance zone that has formed and the price which is moving higher is currently nearing this strong resistance zone. Also, the 200 moving averages coincides in the same level which makes this area a key resistance zone for us. In addition to this, we have a bearish hidden divergence that has formed between the first high that has formed at 1831.70 and the second high that has formed at 1782.51, followed by a continuing bearish divergence based on the MACD indicator. We may consider these as evidences of bearish pressure and also currently there are no signs opposing this bearish view. So in my POV, based on all this, there are two possible scenarios from here. The price might directly move lower from the current zone or alternatively the price might create one push higher, reach the key resistance and then it might bounce lower from this zone. In either ways my view remains bearish here until the key resistance zone holds.

Gold H4(4 Hours) Chart Current Scenario

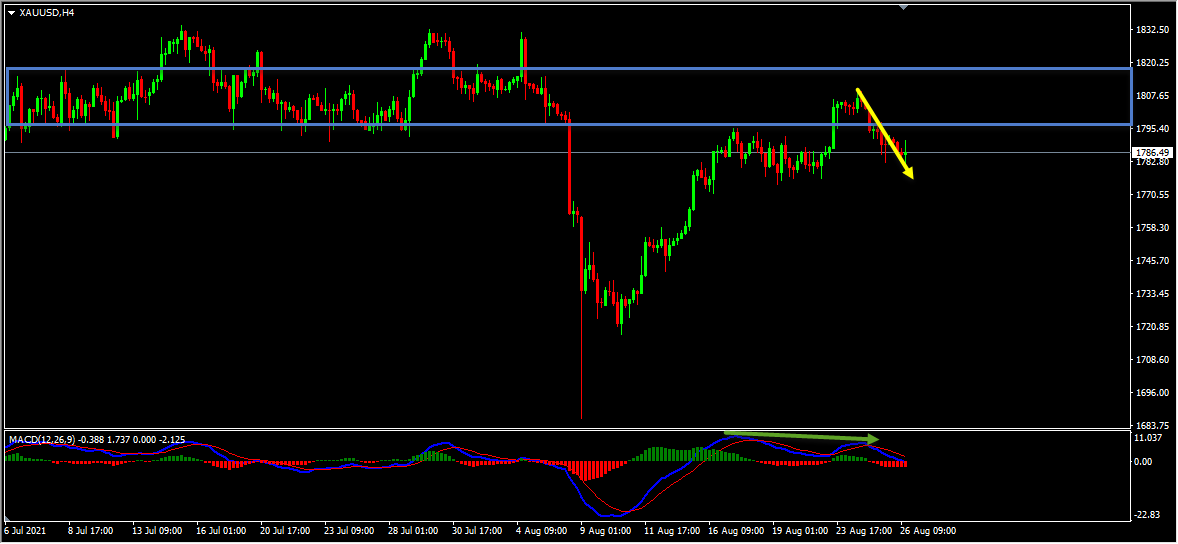

In Gold my view was bearish and I was expecting the price to move lower further based on two possible scenarios. The price action followed my analysis and moved as per scenario 2. The price created one more push higher and reached the strong resistance zone, we also had a bearish divergence based on the MACD indicator which we may consider as a fact provided by the market supporting the bearish view. The price then bounced lower from the strong resistance zone and has delivered an wonderful move to the downside so far!

On the M15 chart, the market provided us with various facts supporting the bearish view. The price which was moving higher created a bearish divergence between the first high that has formed at 1806.39 and the second high that has formed at 1809.40 based on the MACD indicator. The price then moved lower and broke below the most recent uptrend line, we may consider these as facts provided by the market supporting the bearish view and also there we no signs opposing this bearish view. Then as you can see in the image below how the price moved lower further and provided an wonderful move to the downside!

On the M15 chart, the market provided us with various facts supporting the bearish view. The price which was moving higher created a bearish divergence between the first high that has formed at 1806.39 and the second high that has formed at 1809.40 based on the MACD indicator. The price then moved lower and broke below the most recent uptrend line, we may consider these as facts provided by the market supporting the bearish view and also there we no signs opposing this bearish view. Then as you can see in the image below how the price moved lower further and provided an wonderful move to the downside!

(Note: You can learn about a Killer Forex Strategy “Double Trend Line Principle” here)

So, traders, this is why I wanted to show this example to help you understand how important it is to follow the facts. The facts were supporting the bearish view here and there were no signs against it. When the facts do happen as we expected you can see how the price perfectly moved as per the plan. Because these are the kind of hints the market provides us at majority of the times and it’s our obligation as traders to be able to listen to these things that the market tells us and we should try to make the right actions.

So, traders, this is why I wanted to show this example to help you understand how important it is to follow the facts. The facts were supporting the bearish view here and there were no signs against it. When the facts do happen as we expected you can see how the price perfectly moved as per the plan. Because these are the kind of hints the market provides us at majority of the times and it’s our obligation as traders to be able to listen to these things that the market tells us and we should try to make the right actions.

Not sure how to enter a trade? Spot reversals (bounces)? Not sure how to spot breakouts?

I invite you to

Also, you can get one of our strategies free of charge. You will find all the details here

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician