Hello Friends

Good morning, good afternoon and good evening.

Last night we had the Retail Sales economic report come out of Australia, as we know this report measures the change in the total value of sales at the retail level. It is important because this is probably the earliest look at consumer spending which accounts for the majority of an economy’s activity.

As consumer spend, money flows throughout the economy.

Well yesterday numbers showed that people spent less in April versus March.

And as a result the Aussie declined against most of its 16 major trading pairs.

Bloomberg Stats:

“Australia’s dollar fell 0.5 percent to 98.01 U.S. cents as of 4:56 p.m. in Sydney. It lost 0.6 percent to 77.85 yen. New Zealand’s currency declined 0.3 percent to 76.07 cents. It dropped 0.4 percent to 60.43 yen.”

What we can look forward to today:

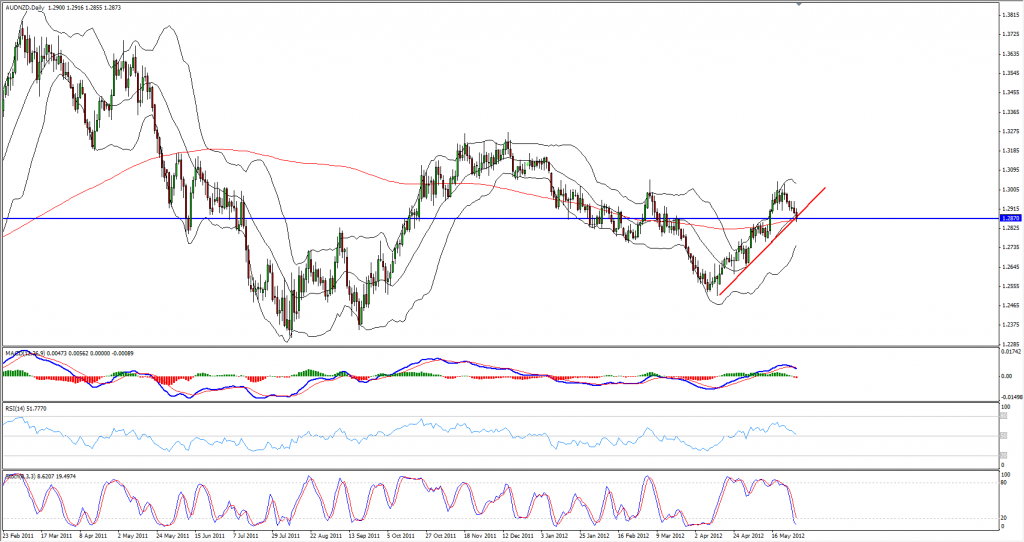

AUDNZD:

We have a beautiful daily trend line along with the 200MA and a support around 1.2834. On the H4 we can see we have potential Bollinger Band duplication to around the support area, we can trade the H4 with the current divergence or we can go to the H1 and trade the continuing divergence. Stop loss should be around 1.2815-1.2810, target will be if we get a straight push down with no retest to the 20MA and we get 20 candle ride the opposite band of the Bollinger Band, but if 20MA will be retested than we have to watch what kind of divergence do we have. If we get regular divergence target will be the upper channel that will be create and if we get continuing the target will be the 20MA for those taking the trade on the H1 chart. if you decide to take the trade on the H4 chart then your target should be the 20MA of the Bollinger Band on the H4 chart.

That’s all for now

Until next time

Vladimir