Hi Traders! In this article we will focus on some of the best and most reliable Forex Chart Patterns and you will learn about how to trade them. I’m going to explain you not only how to trade and when to trade these patterns but also when to skip and not trade them! Which trading patterns are best and how to confirm a breakout or entry for this trading pattern. Remember that not being in a trade is also a trading decision!

Double Tops/Bottoms:

The classical way to trade the double tops/bottoms is as follows:

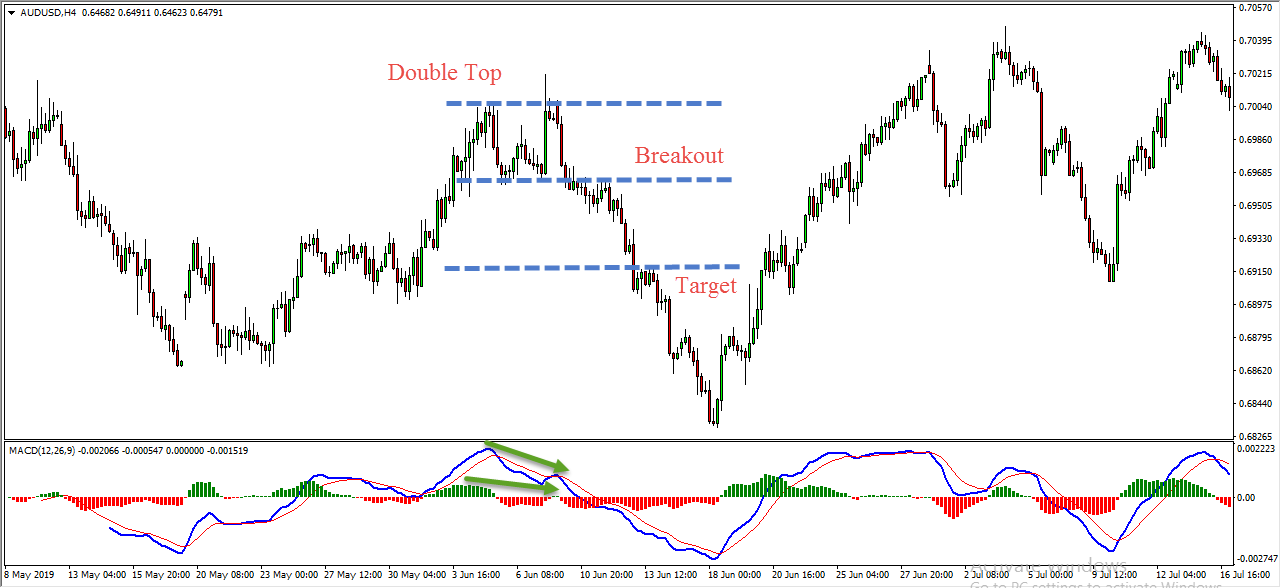

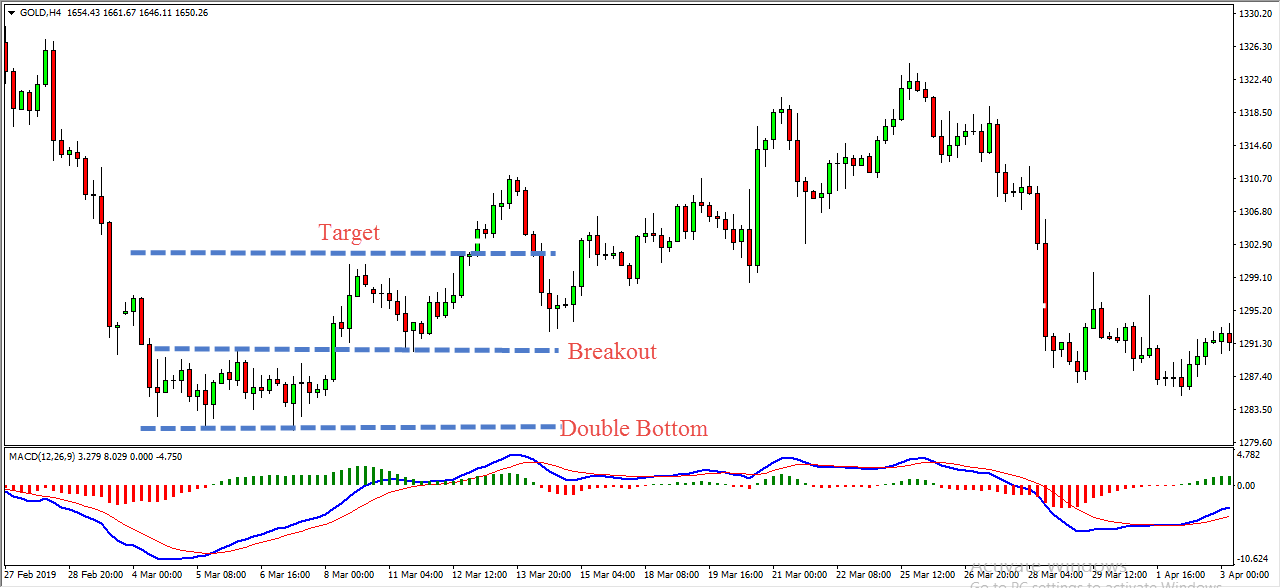

First of all please remember that double tops/bottoms should come at the end of a trend. If its a double top then it should come after an up move, whereas if it is a double bottom then I would like it to come after a down move. We always enter a trade with divergence (To learn and master divergence click here), if its a double top then we enter with bearish divergence, bearish candle, etc… The classical way to trade the double top is by marking the highs and lows, then we look for the breakout of the low and then we sell with the stop loss above the half way of the range (or most recent high before the breakout, if available). The target here would be twice bigger which will be the duplication of the range on the way it broke down (In strong trends, target could be also double the range). Its just the vice versa for the double bottom, it must come after a down move, then it must break and then we join the trade. Stop loss is placed below the half way of the range and the target is duplication of the range from the level it broke up.

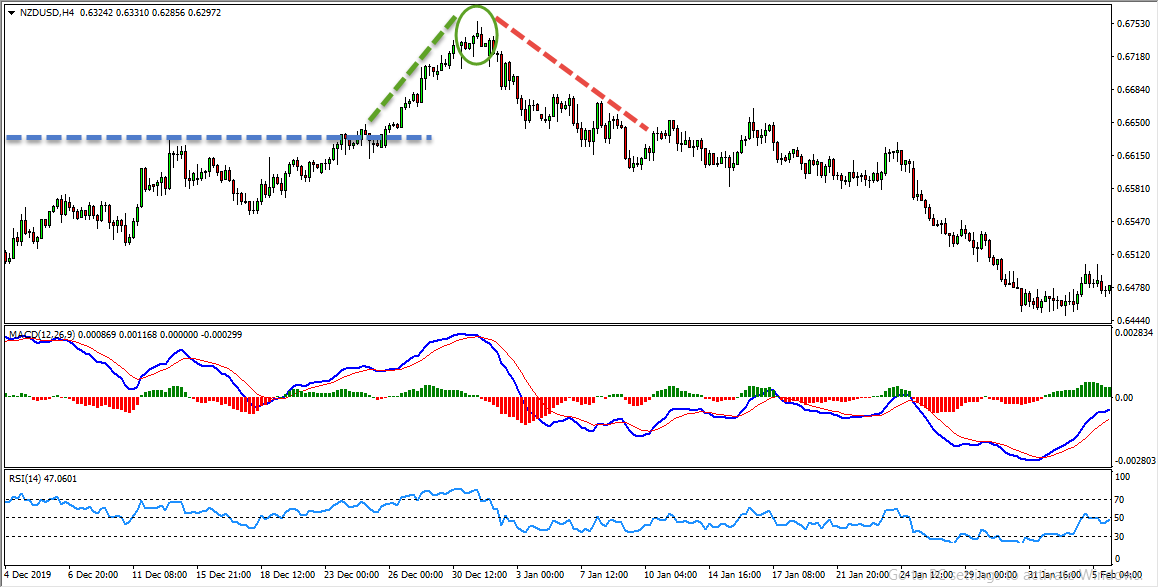

Here is an example of Double Top:

Here is an example of Double Bottom:

I prefer to look for this pattern from the very top or very bottom with patterns and divergences because I think this way we risk less for potential much bigger move.

Double Top Adam & Eve

In the above example the spike is Adam and the big cycle is Eve. There is no difference between this pattern and the classical one which I showed you earlier but here in this case we have a quick spike down then top which moves on the same area more than four or five candles at least. We have the same rules here as well, the break of the low and then down for duplication.

Double Top Eve and Adam

We have the same rules here as well, the break of the low and then down for duplication.

Double Top Eve and Eve

We have the same rules here as well, the break of the low and then down for duplication.

Double Top Adam & Adam

We have the same rules here as well, the break of the low and then down for duplication.

Double Bottom Eve & Adam

We have the same rules here as well, the break of the high and then up for duplication.

Note: Its not very important to remember the names, just look for double tops/bottoms don’t pay attention to the names like if it is Adam & Eve, Eve & Eve, Adam & Adam etc…

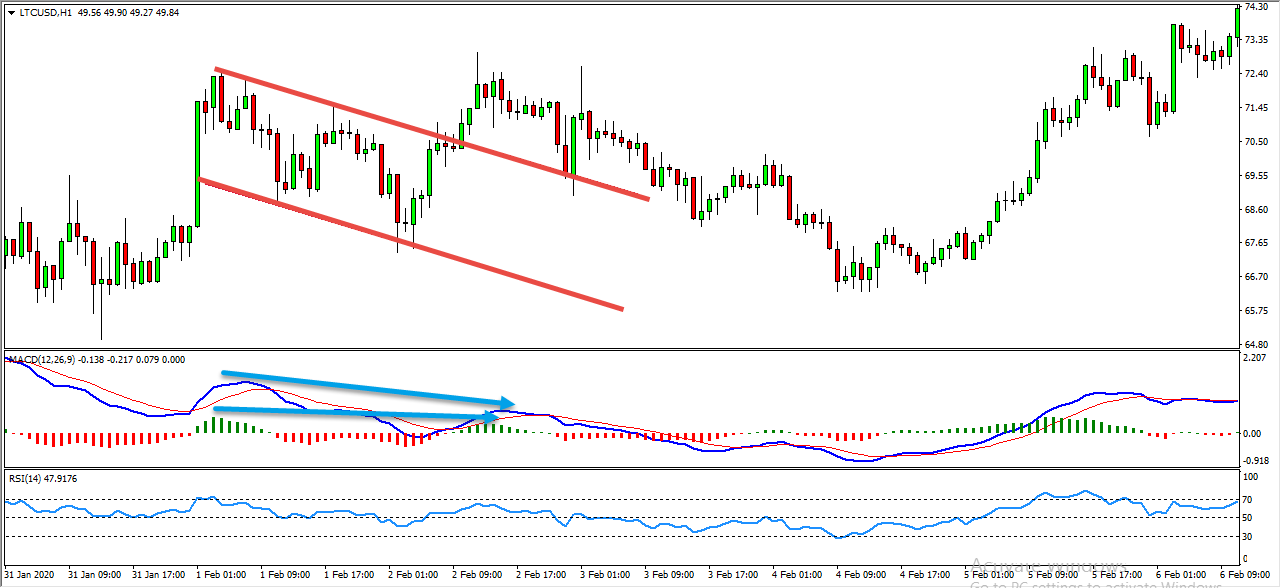

Flags

Sideway Flag

First of all I want to see a trend and then I want to see a side way move, it is much better if you have at least one spike in the side way move which tells you that its a false break, then the next break will be much more reliable. The beauty of trading flags is the risk reward ratio. The entry is with the breakout of the top (that is a close above the top) and here we don’t need to wait for the retest. The stop loss is placed at the middle of the flag and the target is measured from the lowest boundary and duplicate the line from the break

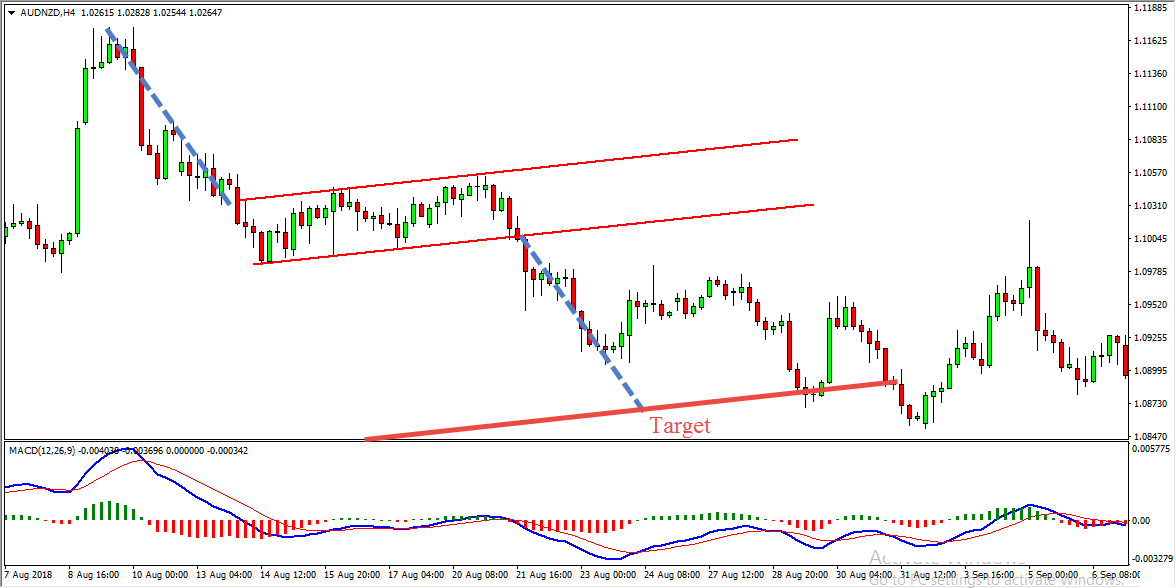

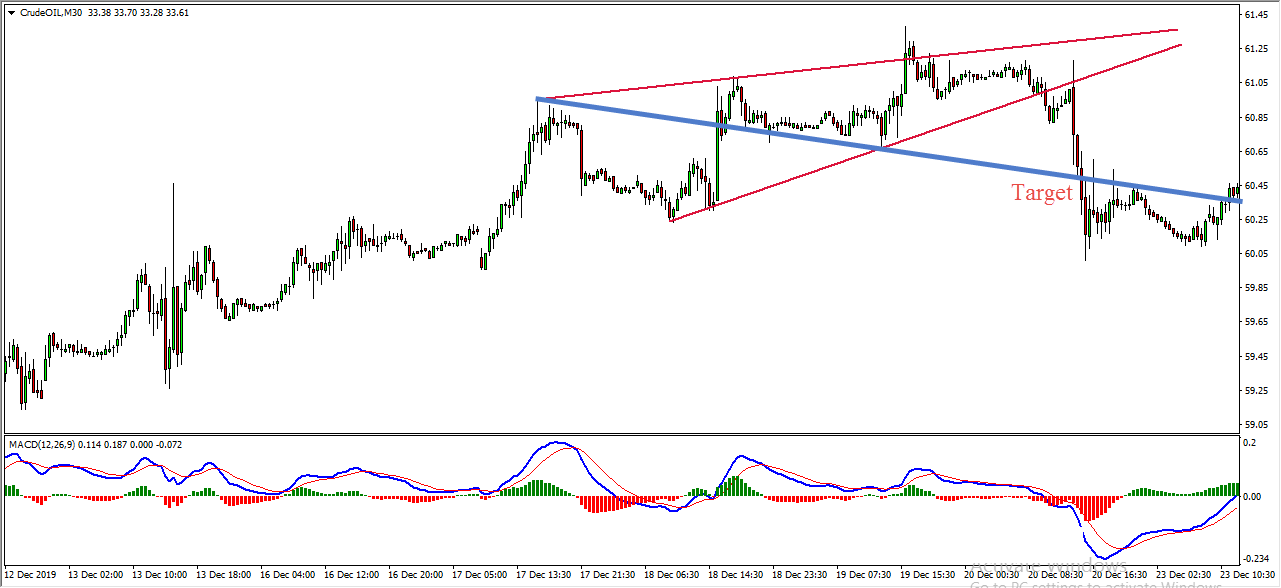

Channel Flag

The channel flag is very similar to that of the side way flag but here it looks like a channel. We have a down move and then the price was moving inside a channel, then we look for the break of the low, close below it and then duplication from the very beginning.

(Note: Flags are not always parallel they could be with different angles, we just need many spots as possible)

In the example shown in the screenshot below the price broke above the top of the flag and moved higher then the price has been blocked by a bearish divergence in such cases just get out of the trade. Generally when you have opposite divergence and candle patterns just get out of the trade. If you want to take the possibility that the divergence will not hold and the market will continue until the next divergence and then retrace all the way, you can just close 80% of the trade and let the 20% work with moving the stop loss to break even (To learn and master divergence click here).

(Note: Personally I don’t like to go against opposite divergences)

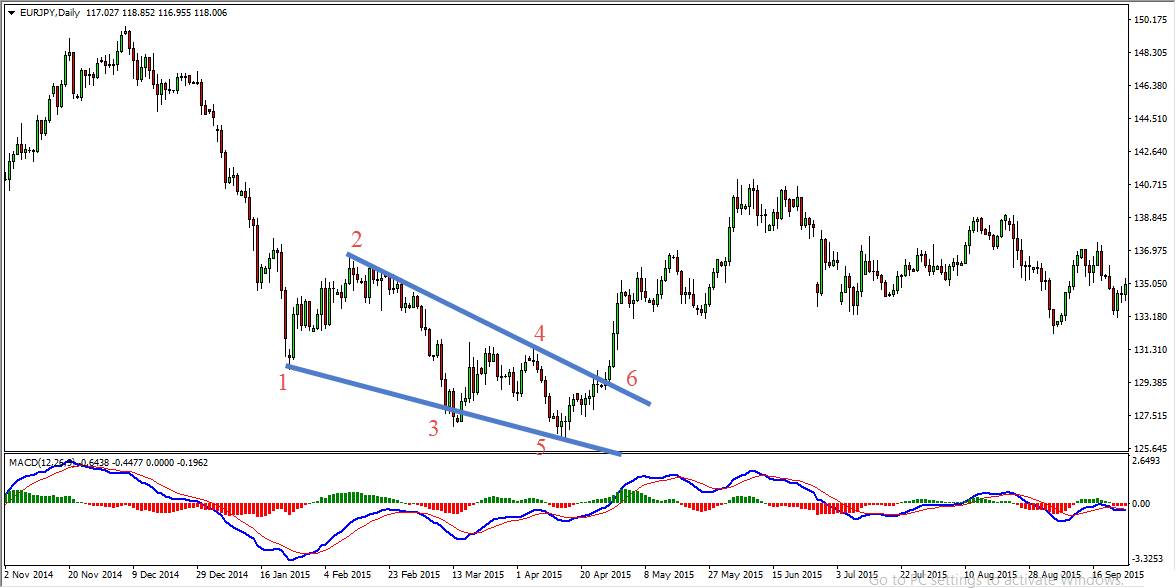

Wedges & Triangles

Bullish Wedge

The bullish wedge must come at the end of down trend and it has to have both boundaries pointing down. As they are not parallel they will try to go and meet each other. To make a wedge or triangle reliable we need to count seven spots on the boundaries. The breakout comes from the 6th or 7th spot, the spot number 3 or 4 could cause false breaks, before a breakout sometimes the market just retrace down and then it might continue.

Bearish Wedge

It is just the vice versa of the bullish wedge.

(Note: There is no rule to count the seven spots)

The target for this one is the meeting of the very first high or low (depends upon bullish or bearish wedge) and the second opposite spot. If the spike to spike measurement is too deep then just go for the close price, you draw a line between the close price and that would be your target.

Note: If the risk reward ratio is lower than 1:1.5 then don’t take the trade.

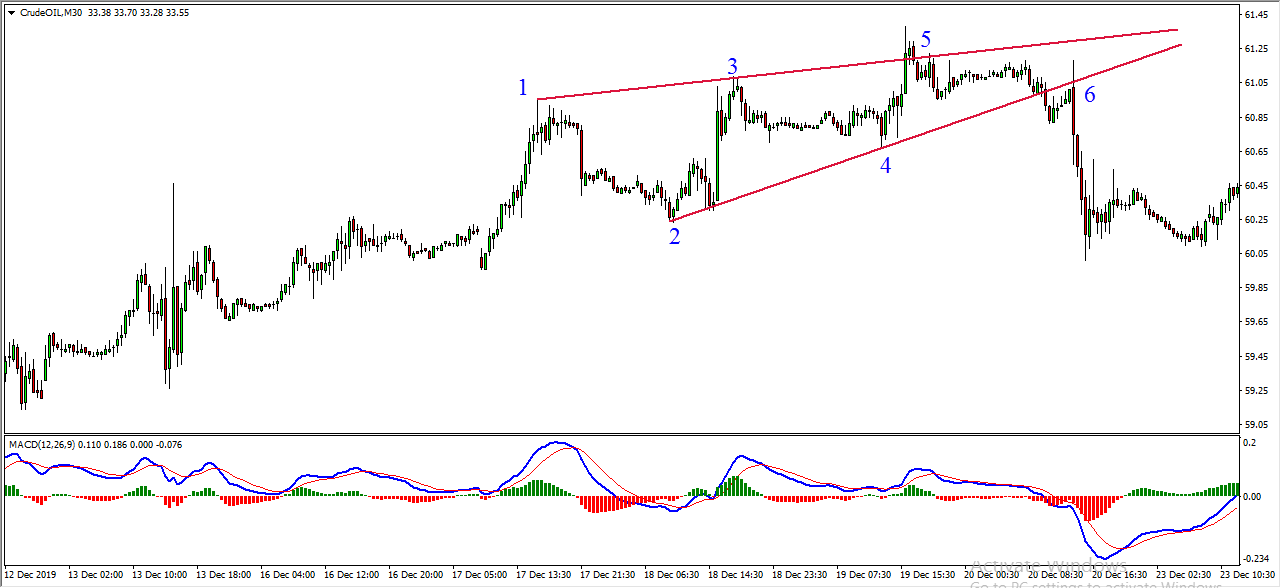

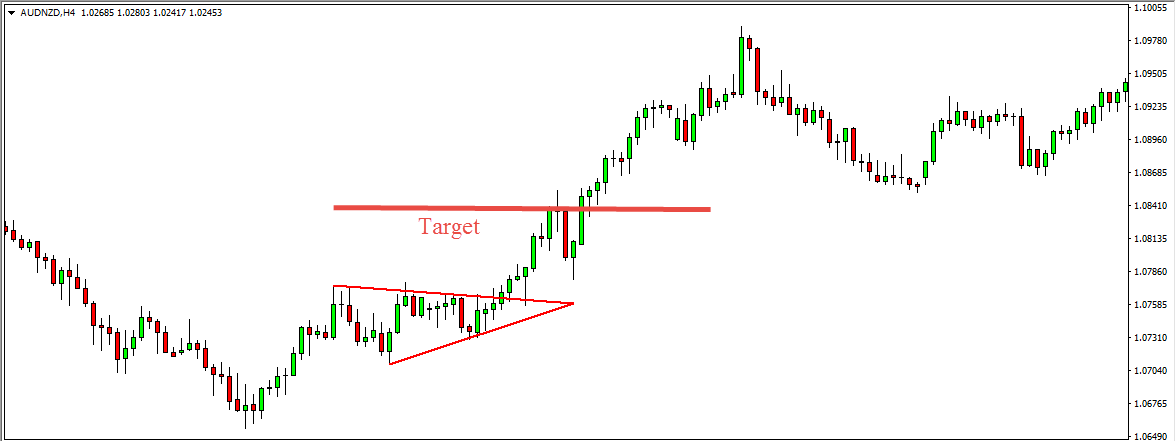

Bullish Triangle

This is pretty much the same as that of the flags, we have spots inside followed by a breakout, this breakout will come on the 6h or 7th spot and the false break could happen on the 3rd or 4th spot. The stop loss is placed at the middle of this triangle. The target is based on the whole move, that is from the lowest point at the very beginning of the triangle until the breakout area and duplicate it from the breakout area to the upside.

Bearish Triangle

It is just the vice versa of the bullish triangle. We have spots inside followed by a breakout, this breakout will come on the 6h or 7th spot and the false break could happen on the 3rd or 4th spot. The stop loss is placed at the middle of this triangle. The target is based on the whole move, that is from the highest point at the very beginning of the triangle until the breakout area and duplicate it from the breakout area to the downside.

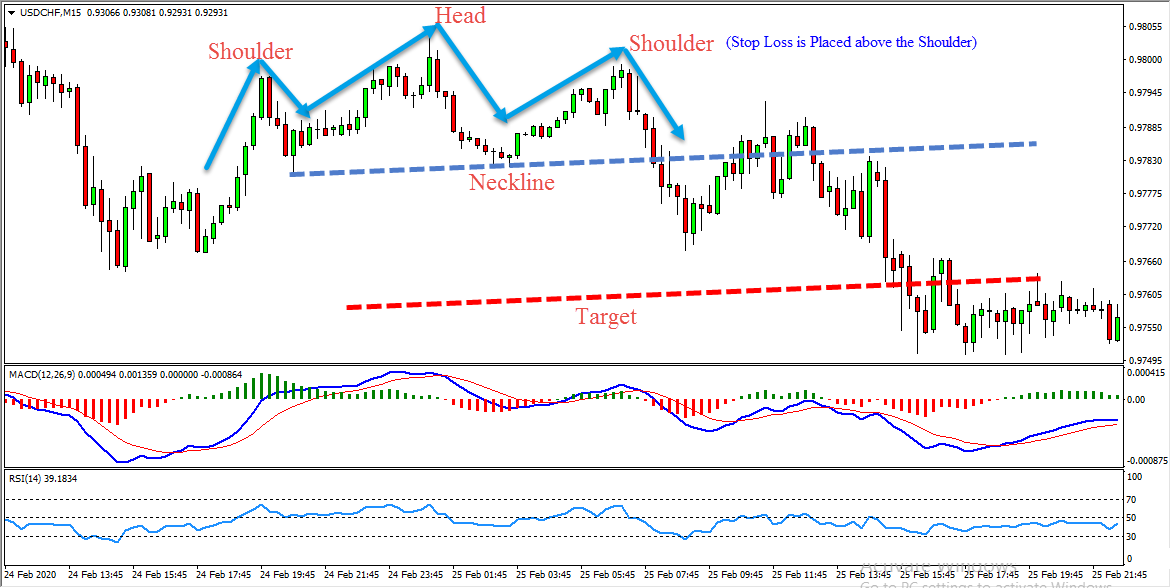

Head & Shoulders Pattern

As shown in the example above this pattern looks like head and shoulders, we can see that the price first created a shoulder then created a head which is higher than the shoulder and then the price moved lower and created another shoulder which is pretty much on the same area as the previous shoulder (it could be a little higher than the previous shoulder but it should be lower than the head). We have a neckline that has formed as shown in the example above and classical analysis says that “look for the break, retest and then sells”. The stop loss is placed above the shoulder and the target is deep as the duplication of the distance from the neckline to the head. But I prefer to start trading the shoulder with the divergence, head and shoulders pattern will always come with divergence.

Fake Head & Shoulders Pattern

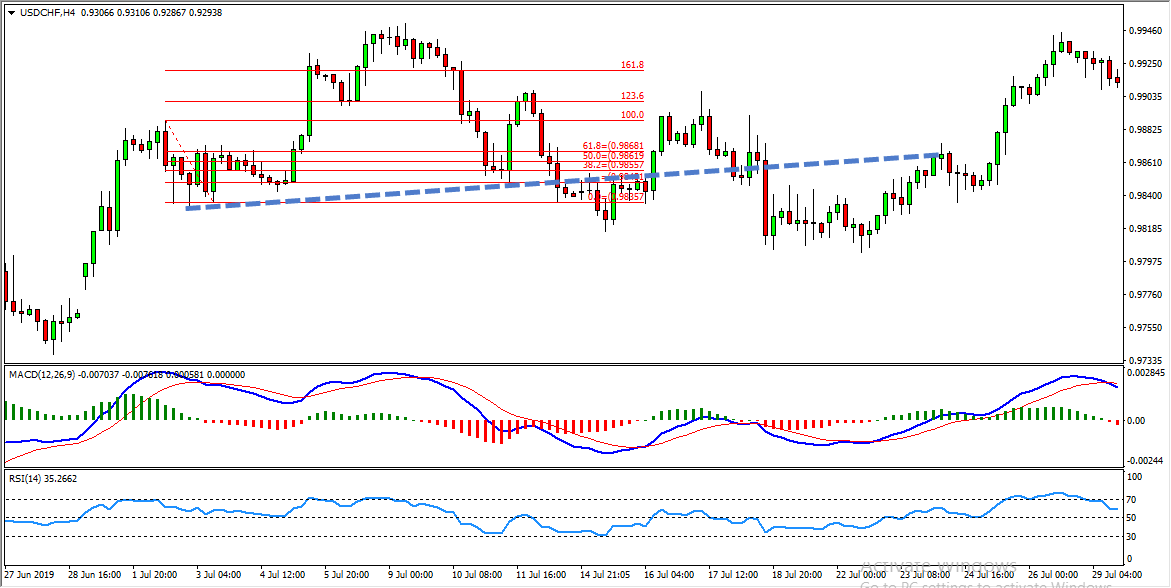

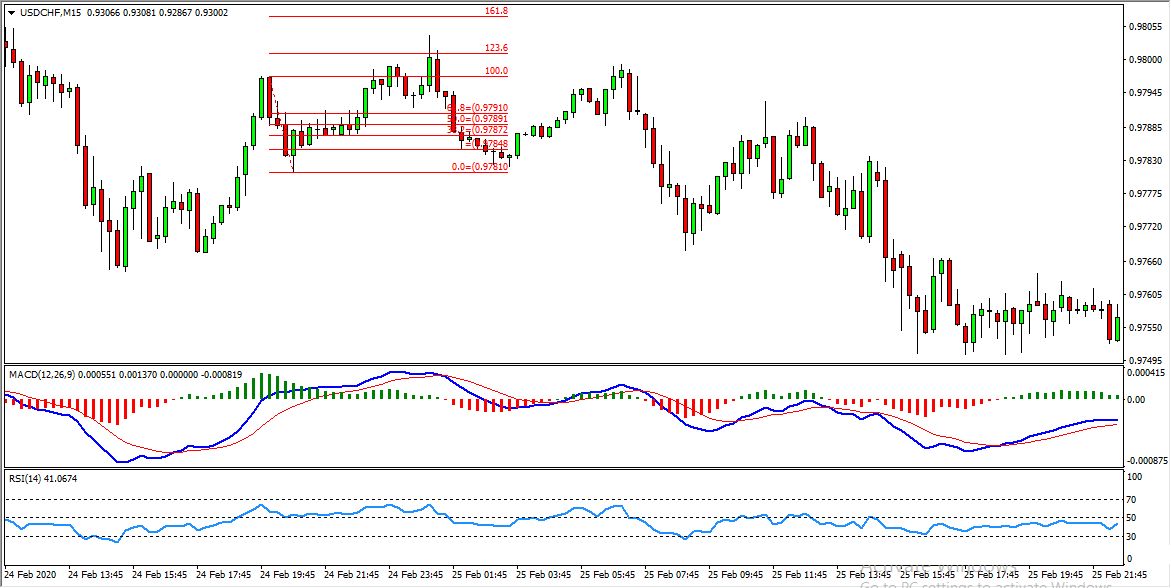

We need to count the head with the help of the fibonacci levels (you add the 123.6 level in the fibonacci retracement tool). First we take the fibonacci retracement tool and count the shoulder from the high to low and the head must stop around the 123.6 level, it could break but it must retrace immediately in, if it doesn’t then it is a false head and this is what we call as a fake head and shoulders pattern.

True Head & Shoulders Pattern

Here is an example of true head and shoulders pattern:

In the below example we took the fibonacci retracement tool and measured the shoulder from the high to low and the head stopped around the 123.6 level perfectly, this is what we call as a true head and shoulders pattern.

V Pattern

This “V” pattern is very risky works only around 35% – 40% of the times because we trade here the false breaks of the support and resistances but the risk reward is a killer here.

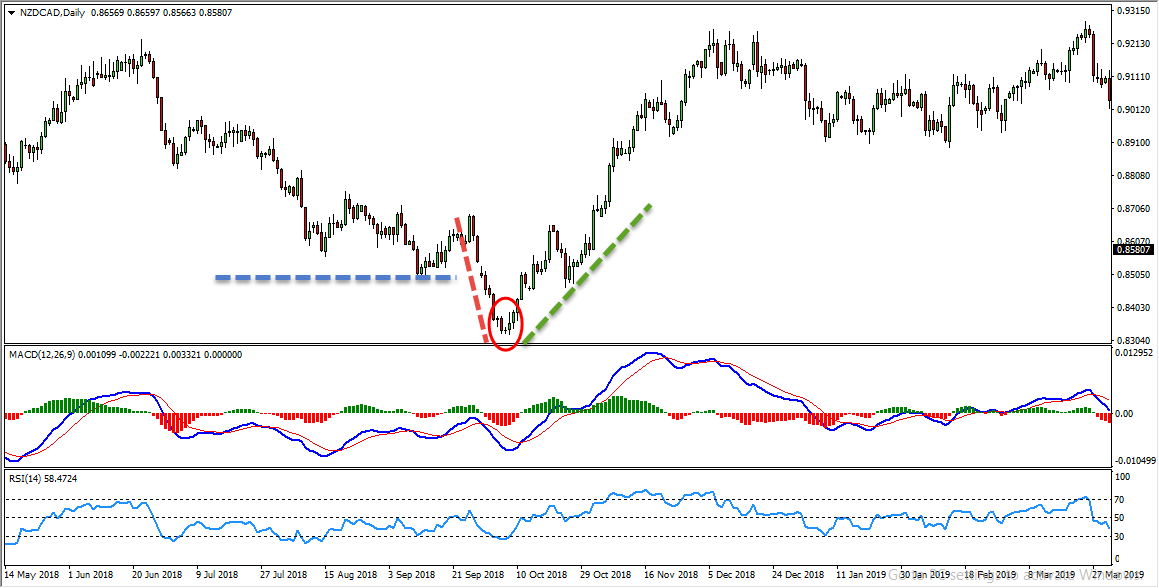

Bullish V Pattern

Look for a straight move, at least 8 candles on the same direction. Look for a strong support level to be broken before the first leg of the “V” pattern. Then the first bullish candle pattern you get, you enter a buy trade and place the stop loss below the last low and the target is at least the previous high. The risk reward ratio here must be 1:4 (1:3 is also ok, it depends on how reliable the “V” pattern is, for example if you have it with divergence).

Bearish V Pattern

Here it is just the vice versa of the bullish “V” pattern and here must look for a straight move to the upside, there should be at least 8 candles on the same direction. The price must break above a strong resistance level. Then the first bearish candle pattern you get, you enter a sell trade and place the stop loss above the last high and the target is at least the previous low. The risk reward ratio here must be 1:4 (1:3 is also ok, it depends on how reliable the “V” pattern is, for example if you have it with divergence).

So traders, this is what I wanted to share with you all about “How To Trade The Best and Most Reliable Forex Chart Patterns”

Here is an useful book for you to learn more about the Forex Chart Patterns, you can get the book here

Watch the webinar of How To Trade The Best and Most Reliable Forex Chart Patterns

Note: If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education.

I invite you to join me in my live trading rooms, on daily basis, and improve your trading with us.

Also you can get one of my strategies free of charge. You will find all the details here

Thank you for your time reading this article.

To your success,

Vladimir Ribakov

Thank you vld