Hi Traders!, Weekly Forex Forecast 25th September 2022 is here. In this post, I analyze and forecast EURUSD and USDCAD. EURUSD is expected to continue its current bearish trend and for me selling the rallies plan is the correct one at the moment. USDCAD is likely to continue the bullish run; however, I expect it to face a key resistance around the weekly supply levels of 1.3650-1.3850.. A detailed analysis of these two instruments are as follows:

You can watch the video explanation of this forecast here:

EURUSD

MN – On the monthly chart, we could see that the price is in a bearish trend with the price creating lower highs, lower lows structure.

Very likely, I expect the price to retest the strong support zone shown in the image below. So basically, I expect the price to reach this support zone and then we may expect a possible slow down.

D1 – On the daily chart, the price is moving inside a bearish channel and currently, it looks like the price still has room lower towards the bottom of this channel. I anticipate the price to reach the bottom of this channel and very likely we may expect a bullish divergence to build up based on the MACD and RSI indicator and then the price may eventually slow down.

Until that happens on the daily timeframe, I will be looking on the lower timeframes to sell the rallies with bearish evidences.

Note: In my Traders Academy Club we are already involved in this EURUSD sell trade last week. On the H1 chart, we had lower highs, lower lows in play, then we had a pullback with the price creating a bearish hidden divergence and this is where we got involved and we are already riding this sell trade and I believe very likely this bearish run is not over yet. So if you missed this ride then sell the rallies still remains the plan here in my POV.

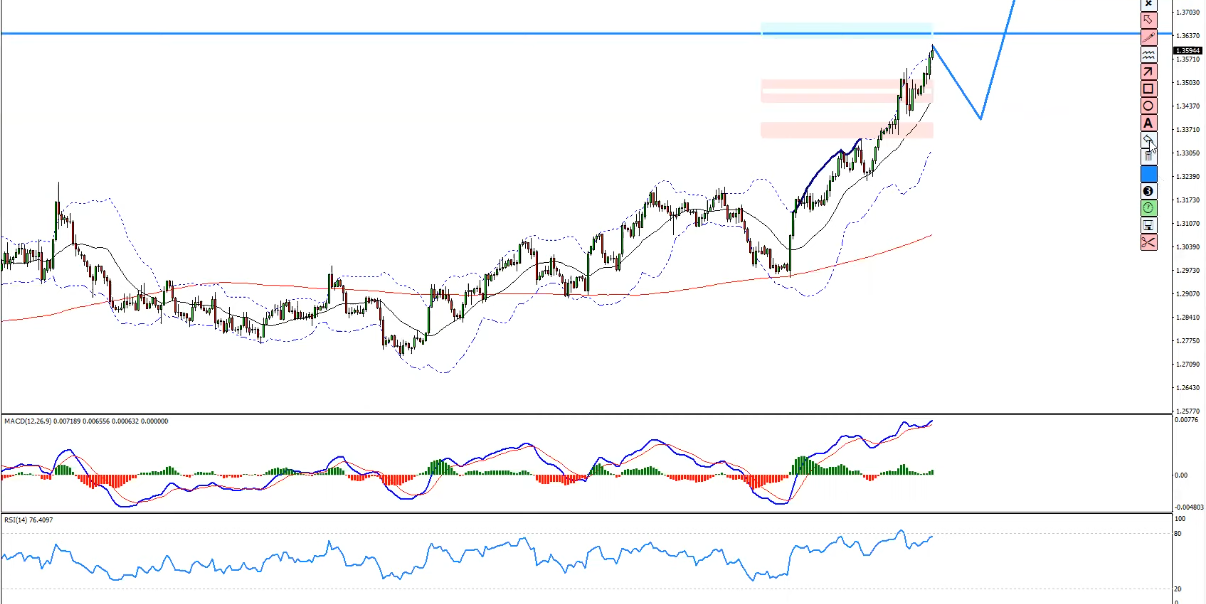

USDCAD

D1 – In this pair, on the daily chart the price is currently moving higher and I anticipate the price to be blocked in a key resistance zone shown in the image below. This key resistance zone is formed based on the previous highs and I expect to see short term fight before further continuation higher.

The closer the price gets to this key resistance zone, we may start to see some slow down and eventually a possible correction to happen here, which might provide us an amazing trading opportunity.

H4 – On the H4 chart, we don’t have any reversal signs yet. So, we need to look for reversal signs like bearish divergence on the MACD indicator or with the price creating three lower highs, lower lows structure.

As long as it didn’t happen and if we get drops without reversal signs then I believe it’s a good opportunity to join the rally to reach inside the key resistance zone.

Alternatively, if the market creates bearish divergence with false breaks then we may consider it as a sign that the buyers are slowing down and may expect a pullback to happen here.

Download my best indicators here here

Join our trading family and enjoy all our REAL-TIME trading opportunities and REAL-TIME trading education!

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

If you have any further questions, don’t hesitate to drop a comment below!

Yours to your success,

Vladimir Ribakov

Certified Financial Technician