Hi Traders! Arvinth here from Traders Academy Club team. Weekly summary and review April 29th, 2022 is here. It is now time to recap and summarize the trade setups that we had during this week. Below you will find the short explanation of all the trade setups we had this week and how it has currently developed now.

Trading Ideas (Blog Posts)

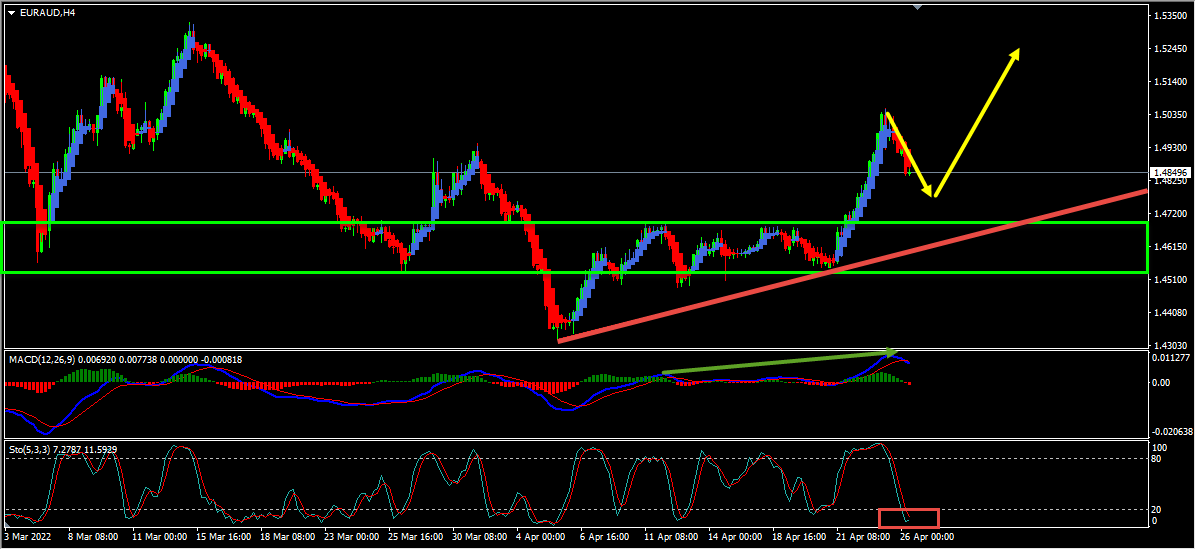

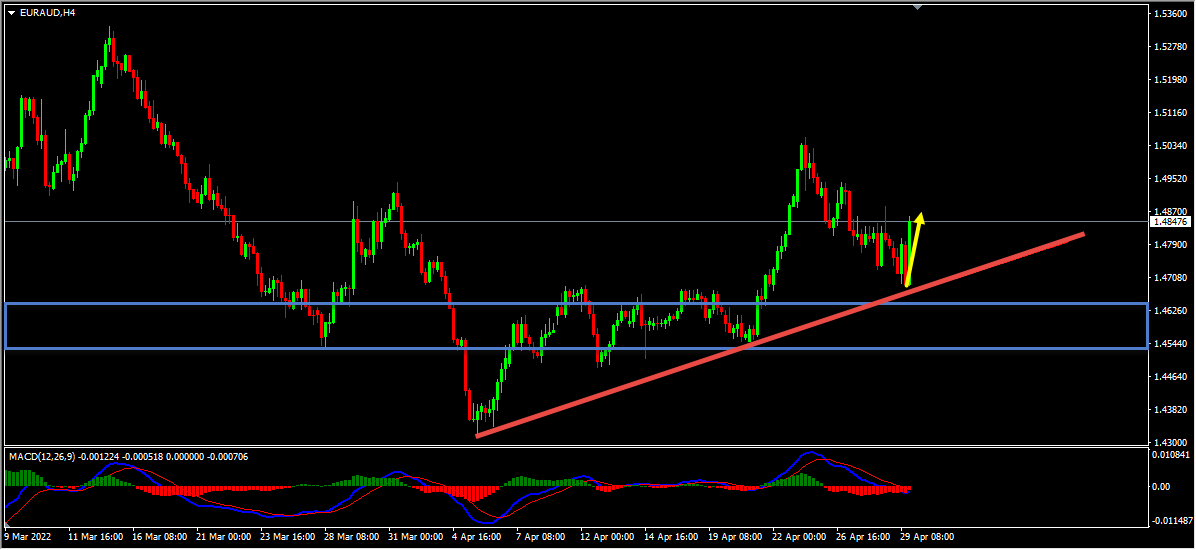

EURAUD – My idea here was “On the H4 chart, we have a bullish rally and currently it looks like this bullish rally is about to continue itself. Based on the Heikin Ashi candles we can see that currently, we have strong bullish bodies in upward moving market conditions so it basically reflects a bullish environment. Also, the price which was moving higher has created higher highs based on the MACD indicator, which is a sign of gaining momentum towards the bullish side. In addition to this, based on the Stochastic Oscillator, we could see that the price has reached it’s extreme, we may consider it as yet another evidence of bullish pressure. Also, the price which is moving lower is currently nearing a key support zone, where the most recent uptrend line coincides. Until this key support zone holds my short term view remains bullish here and I expect the price to move higher further”.

Current Scenario – In this pair my short term view was bullish and I was expecting the price to move higher further until the key support zone holds. The price action followed my analysis exactly as I expected it to here. After the higher highs, we had a pullback and the price which is currently moving higher has delivered 180+ pips move so far!

NZDJPY – My idea here was “On the H1 chart, based on the Heikin Ashi candles we can see that currently, we have strong bearish bodies in downward moving market conditions so it basically reflects a bearish environment. In addition to this, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a correction is happening. Also, we had two strong support zones that has formed and the price which is moving lower has broken below these zones and is holding below them, we may consider this as yet another evidence of bearish pressure. Currently, these strong support zones are acting as strong resistance zones for us. Until these two strong resistance zones hold my short term view remains bearish here and I expect the price to move lower further”.

Current Scenario – In NZDJPY, my short term view was bearish and I was expecting the price to move lower further until the two strong resistance zones hold. The price action followed my analysis exactly as I expected it to here. The price which was moving higher reached the first strong resistance zone, created a false break of it and then the price moved lower and delivered around 150 pips move so far!

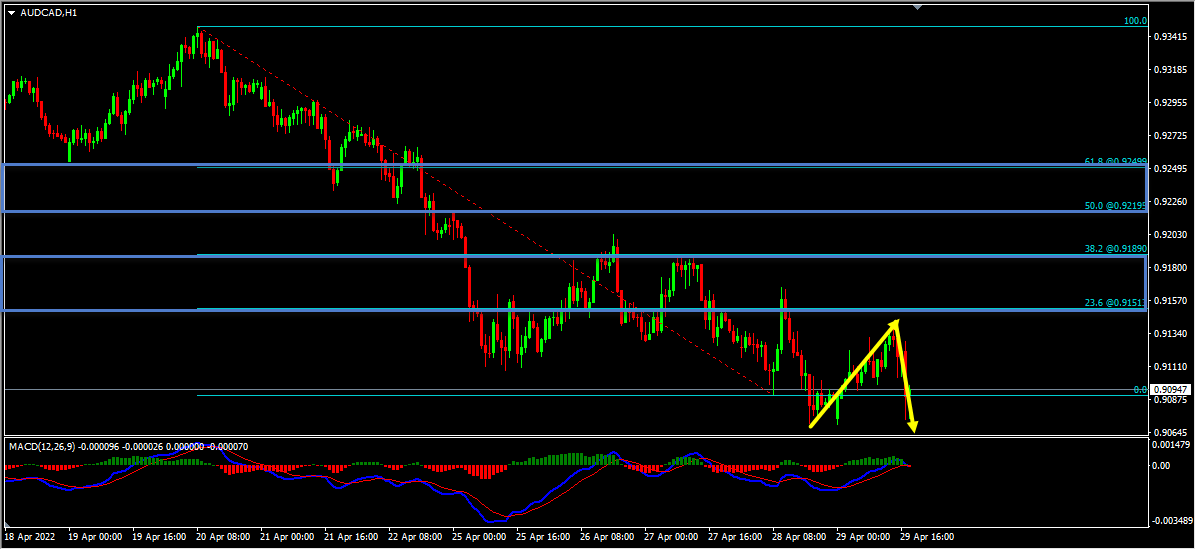

AUDCAD – My idea here was “On the H4 chart, based on the Heikin Ashi candles we can see that currently, we have strong bearish bodies in downward moving market conditions here as well, so it basically reflects a bearish environment. In addition to this, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a correction is happening. Also, while measuring this bearish trend pattern using the Fibonacci retracement tool we have two key resistance zones that has formed. The first key resistance zone is formed by the 23.8%(0.91920) and 38.2%(0.92538) Fibonacci retracement zones of the bearish trend pattern. The second key resistance zone is formed by the 50%(0.93037) and 61.8%(0.93536) Fibonacci retracement zones of the bearish trend pattern. Until these two key resistance zones hold my view remains bearish here and I expect the price to move lower further”. Current Scenario – In AUDCAD, the price action is following the bearish expectations so far. We had a pullback and then the price which is moving lower has delivered 60+ pips move to the downside.

Current Scenario – In AUDCAD, the price action is following the bearish expectations so far. We had a pullback and then the price which is moving lower has delivered 60+ pips move to the downside. Note: You can follow us here on Trading View and also on our blog to get similar ideas on daily basis)

Note: You can follow us here on Trading View and also on our blog to get similar ideas on daily basis)

For similar trade ideas and much more I invite you to join the Traders Academy Club and improve your trading with us.

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Traders Academy Club Team.