Hi Traders! Weekly Summary And Review April 2nd, 2021 is here. It is now time to recap and summarize the trade setups that we had during this week. Below you will find the short explanation of all the trade setups we had in this week and how it has currently developed now.

First, we will see the trade ideas that I shared in my blog:

Trading Ideas (Blog Posts)

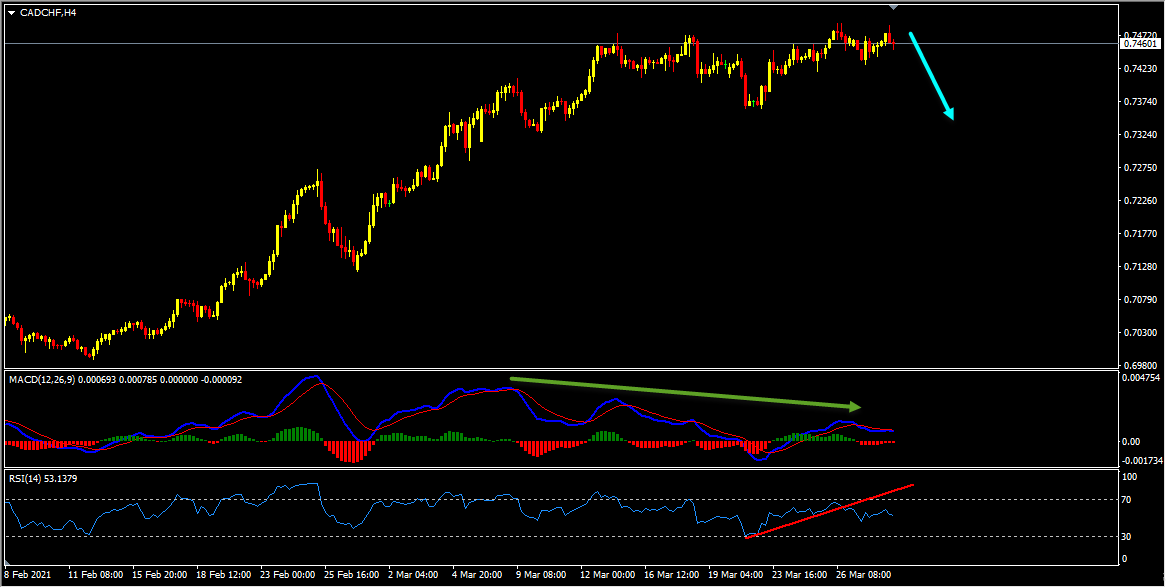

CADCHF – My idea here was “On the H4 chart we have a bearish divergence that has formed between the first high that has formed on 9th March 2021 and the second high that has formed on 26th March 2021 based on the MACD indicator which we may consider as evidence of bearish pressure. Also in addition to this we have an uptrend line breakout based on the RSI indicator which we may consider as another evidence of bearish pressure. So based on all this my view here is bearish and I expect the price to move lower further”.

Current Scenario – In this pair my bearish view still remains the same and I expect the price to move lower further in the short term.

Current Scenario – In this pair my bearish view still remains the same and I expect the price to move lower further in the short term.

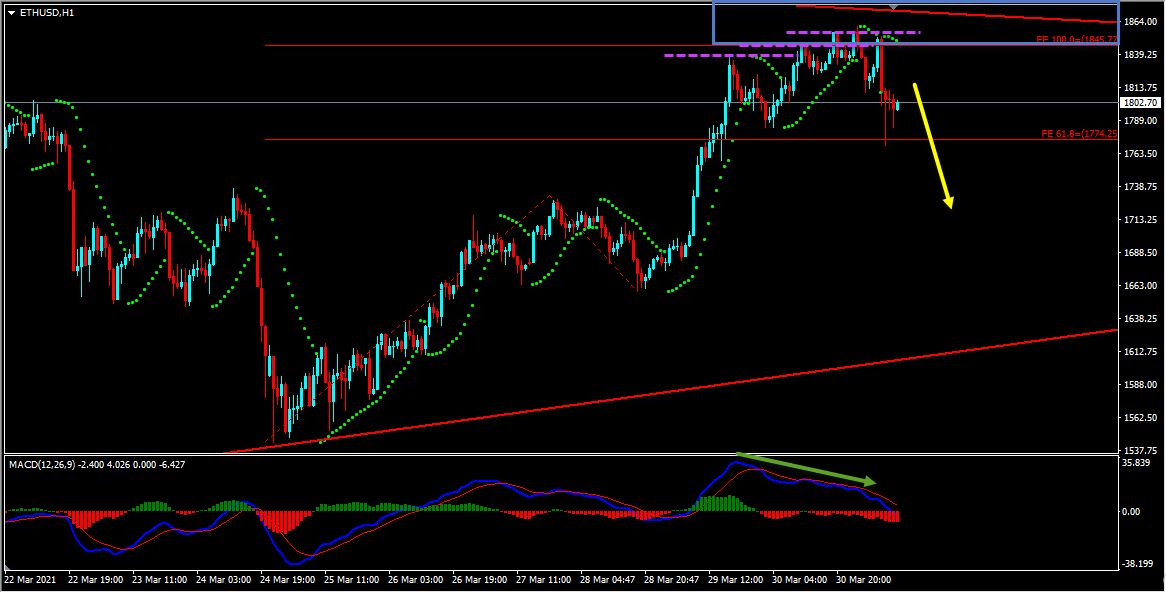

Ethereum – My idea here was “On the H1 chart the price which was moving higher has created multiple false breaks with a bearish divergence that has formed between the first high that has formed at 1837.75 and the second high that has formed at 1860.20 based on the MACD indicator which we may consider as evidence of bearish pressure. In addition to this based on the Parabolic Sar we could see that the dots are above the price which we may consider as another evidence of bearish pressure. Also currently there are no signs opposing this bearish view. So everything looks good here for the bears and based on all this my short term view here is bearish”.

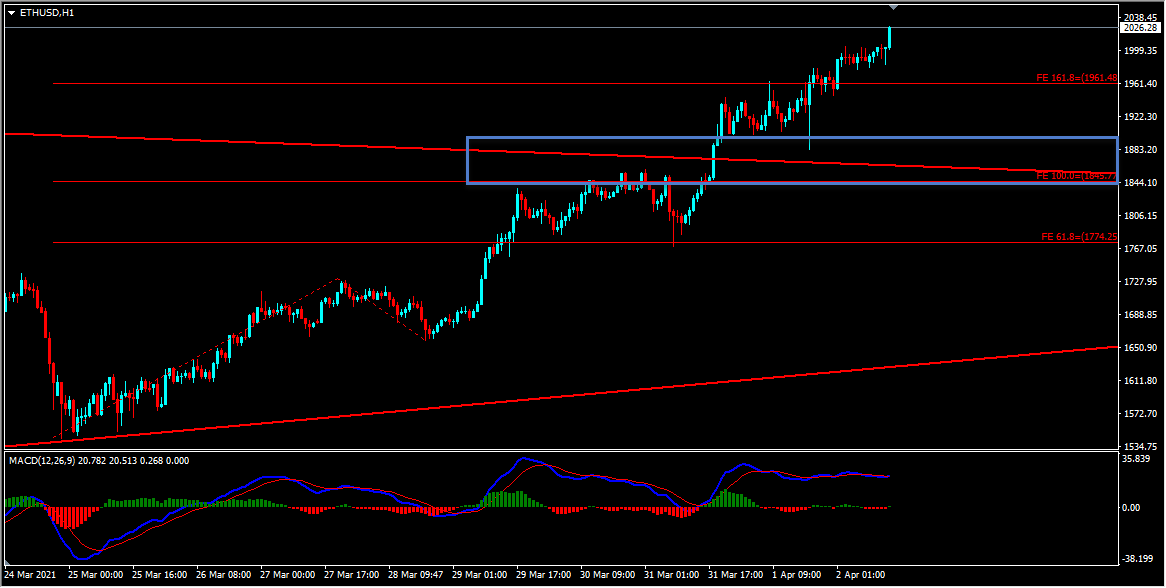

Current Scenario – Based on the above mentioned analysis my view was bearish here and I mentioned that until the key resistance zone holds I expect the price to move lower further. The price action didn’t follow my analysis here and this idea failed. After multiple false breaks and bearish divergence I was expecting the price to move lower further from the key resistance zone but the price moved higher, broke above the key resistance zone and is currently holding above it, thus invalidating this bearish view. My current view on Ethereum is neutral.

Current Scenario – Based on the above mentioned analysis my view was bearish here and I mentioned that until the key resistance zone holds I expect the price to move lower further. The price action didn’t follow my analysis here and this idea failed. After multiple false breaks and bearish divergence I was expecting the price to move lower further from the key resistance zone but the price moved higher, broke above the key resistance zone and is currently holding above it, thus invalidating this bearish view. My current view on Ethereum is neutral.

Trading Ideas (Trading View Posts)

Oil – My idea here was as follows:

Current Scenario – My plan didn’t change here in Oil, that is until the strong resistance zone holds I expect the price to move lower further.

Current Scenario – My plan didn’t change here in Oil, that is until the strong resistance zone holds I expect the price to move lower further.

EURUSD – My idea here was as follows:

Current Scenario – In this pair the price is following the bullish expectations so far, my bullish view still remains the same here.

Current Scenario – In this pair the price is following the bullish expectations so far, my bullish view still remains the same here.

NZDCHF – My idea here was as follows:

Current Scenario – Based on the above mentioned analysis my view was bullish here and I was expecting the price to move higher further until the strong support holds. My view still remains the same here.

Current Scenario – Based on the above mentioned analysis my view was bullish here and I was expecting the price to move higher further until the strong support holds. My view still remains the same here.

Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

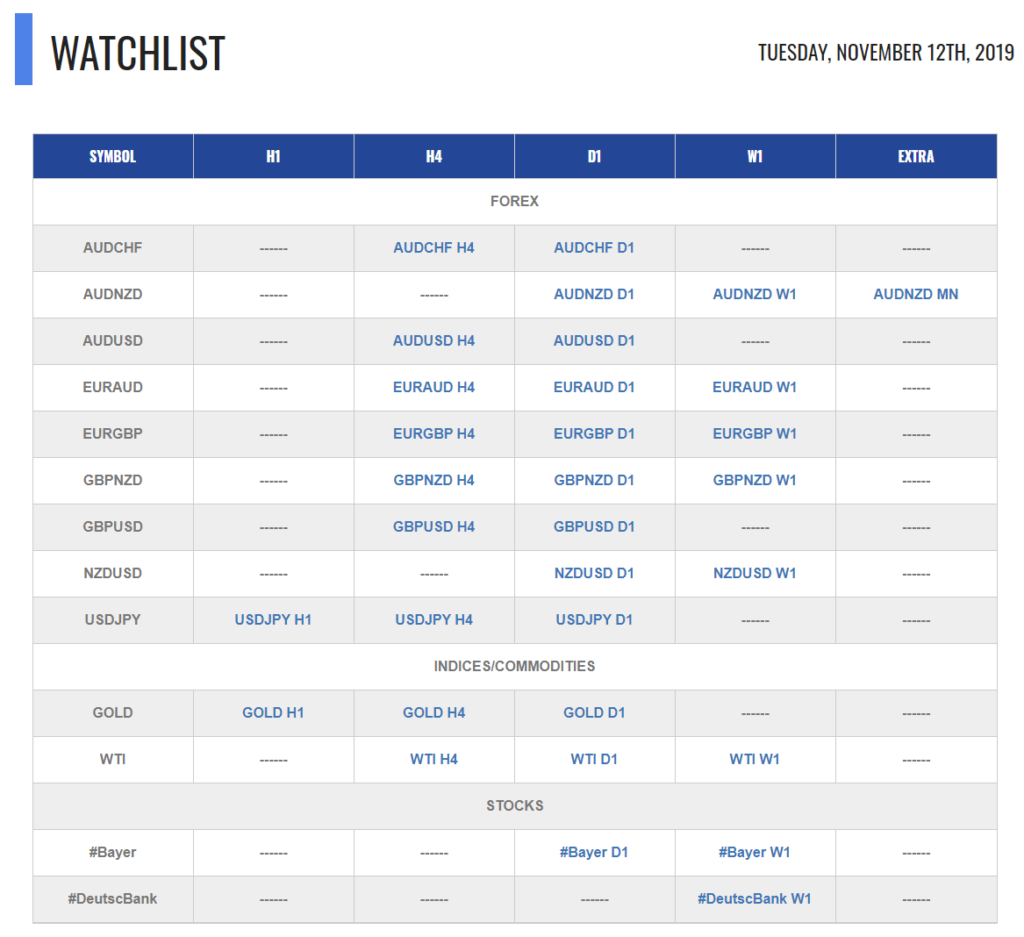

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Market Analysis every single day.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician

Thank you