CM Trading is an FSCA (Financial Sector Conduct Authority) regulated broker that made its debut into the foreign exchange arena in 2012.

Operating as a brand name of Global Capital Markets Trading, CMTrading claims to be South Africa’s largest broker for the past few years while their regulatory oversight promotes a safe trading environment for investors of all experience levels.

Supported financial instruments (investable assets) include forex, CFDs, commodities, indexes, and metals.

CM Trading Pros & Cons

Cons

- Limited Geo availability

- Limited trading platforms provided

Pros

- FSCA Regulated

- Supports EAs & Trading Robots

- CopyKat Social Trading Feature

- Best Financial Broker 2019 Award (Africa)

Trading Fees

Increased transparency tends to be a byproduct of regulated brokers but we have to admit that we weren’t impressed with how CM Trading failed to include vital information such as fees associated with their platform.

After combing through the site’s page we were unable to find any trading, withdrawal or disclosed fees of any kind.

When we went to chat with the live chat support no agents were available either, therefore, making it more difficult for us to find the information we desired.

Additionally, other review portals who have gone on to review CM Trading tend to skim over the associated fees of CM Trading, so whether or not CM Trading has fees automatically employed into their spreads we are not certain but we predict that is likely the case.

Apart from this instance CM Trading appears well-constructed and provides the relevant information that traders seek before investing live with their platform.

Account Opening [+ Types]

CM Trading offers a seamless and hassle-free account registration process.

Additionally, the platform offers a Free Demo Account while traders have access to trade on their platform a few minutes after registration and funding have been approved.

Minimum Deposit: $250

Maximum Deposit: $50,000+

Support Payment Methods: Visa, MasterCard, TrustWave, Neteller, FasaPay, UPayCard, and PowerCash21.

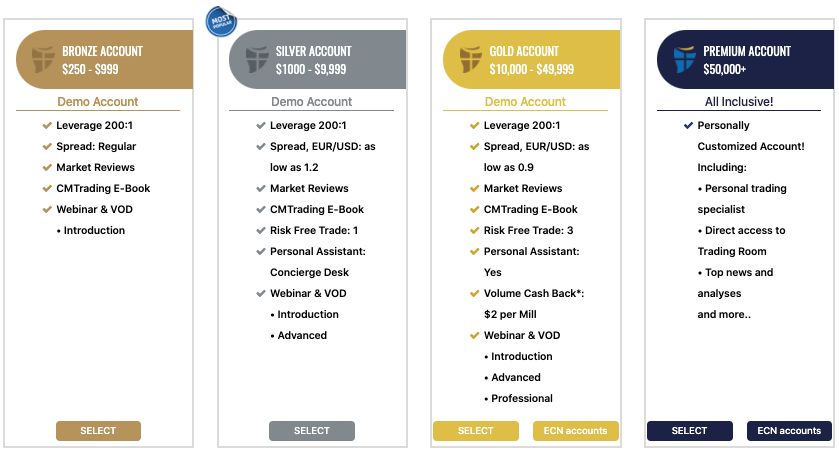

What kind of account types are available with CM Trading?

- Bronze Account – $250 Deposit Requirement, Leverage 200:1 and Access to Market Reviews, CM Trading e-Book, and Educational Webinars.

- Silver Account – $1,000 Deposit Requirement, All Bronze Account Features, Spreads As Low as 1.2, Personal Assistance, 1 Risk-Free Trade, and Additional Educational Resources.

- Gold Account – $10,000 Deposit Minimum, Spreads As Low as 0.9, 3 Risk-Free Trades, Extensive Educational and e-Learning Resources, and Silver Account Features Unlocked.

- Premium Account – $50,000 Deposit Minimum, Fully-Customizable Account, Personal Trading Assistant, Direct Access to Trading Room, Analyzes and All Gold Account Features.

Deposit & Withdrawal

You may be pleased to hear that CM Trading holds their client’s funds in segregated accounts in Nedbank and Barclays PLC, which ensures the safety of client funds.

The minimum withdrawal requirement of CM Trading is $20 while withdrawals are generally received between 4 to 8 business days.

Supported Base Currencies: US Dollars or Euros

Should any issues occurring through the banking process with CM Trading clients are urged to contact finance@cmtrading.com.

Regulations

CM Trading is regulated by the Financial Sector Conduct Authority (FSCA).

The FSCA is the only regulatory body for financial institutions in South Africa such as banks, retirement funds, insurers, administrators, and market infrastructures.

Only 81 brokers have been able to obtain FSCA licensing and CM Trading has been able to do so since 2012.

The FSP Number (38782) may be used to verify CM Trading’s license through the site: https://www.fsca.co.za/Fais/Search_FSP.htm.

Trading Features & Products

Trading Platform

CM Trading provides a few different trading platforms.

- MetaTrader4 (MT4)

- Sirix Platform

- CM Trading App

We were a little disappointed that CM Trading did not support additional trading platforms or more tech-savvy features for their traders.

Despite the short-coming for desktop-style investors, the Sirix Platform and CM Trading App marriages together a great platform ideal for traders on-the-go or for investors who prefer mobile trading over desktop investing.

Education

Compared to competing brokers, CM Trading offers what can be considered a slightly above industry standard for accessible educational resources.

Unfortunately, some of the educational resources are locked depending upon your trading account type while traders who deposit more into the platform have access to more trading features, educational resources, and investment perks.

Among the subjects discussed through CM Trading educational resources include:

- Online Trading Videos

- Technical Analysis

- Fundamental Analysis

- Educational Trading Webinars

- Guardian Angel

- Expert Advisors (EAs)

- CM Trading Signals (How To Use Them Effectively)

Customer Service

CM Trading provides a relatively decent customer support staff on their site but we aren’t raving about how helpful they were in answering our questions, oftentimes directing us to other undisclosed pages on their site to seek our answer.

We must admit, however, that when it comes to addressing client complaints or trading issues that the staff not only answers promptly but tends to render a swift resolution – so that is a great trait for prospective traders.

Bottom Line

South African traders would be hard-pressed to find a regulated FX and CFD broker as reputable and safe as CM Trading.

CM Trading trading platform favors mobile traders while the platform’s social trading feature, CopyKat, is widely used by novice traders to execute the same trades as the best performing day traders on the platform.

Customer support efficiency tends to vary depending upon the time of day while traders should exercise caution before accepting any bonus or incentives offered on the platform due to bonus conditions that must be met before withdrawals are approved.

All-in-all, CM Trading will continue to be the forex broker of choice amongst South African traders for the foreseeable future while we look forward to the advancements and future implementations that this broker intends to integrate in the months to follow.